By Lydian Kennin

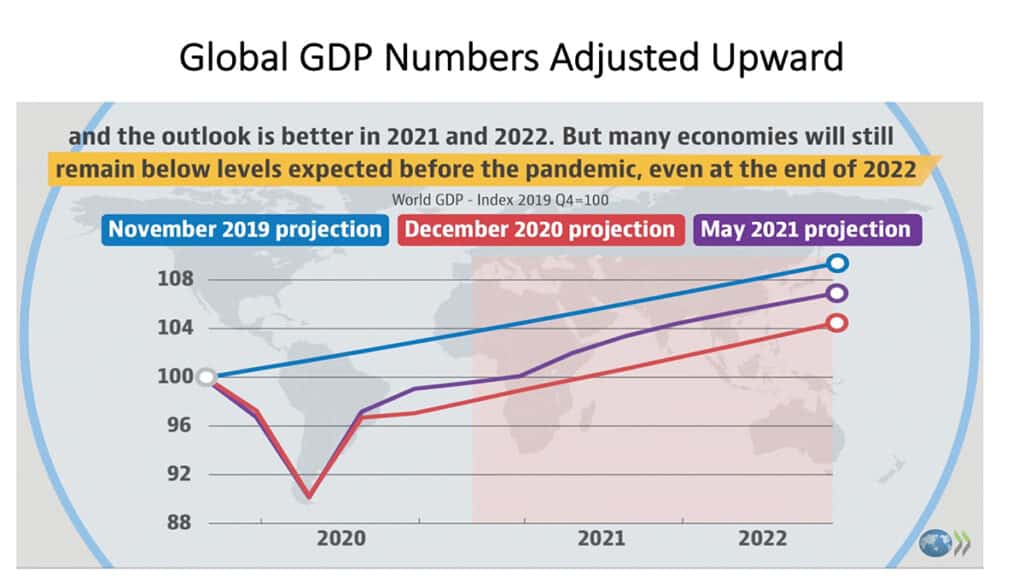

The Organization for Economic Cooperation and Development (OECD)’s pre-pandemic projection for global GDP was for an eight to nine percent growth by the end of 2022. In the midst of COVID-19, the 2020 projection fell downward, but the projection was revised in May of 2021, showing an optimistic future market.

Michael Snow, executive director of the American Hardwood Export Council (AHEC), stated in a recent webinar that ending the pandemic remains the key to economic recovery for the second half of 2021.

“Back at the beginning of the year, (the U.S.) ranked fifth in the world of the population vaccinated and we were by far the biggest of those top-tier countries. We did a great job in the initial rollout of getting people vaccinated; but now, we have fallen into 28th place on vaccination rates… that is really a danger to our economy moving forward,” Snow said.

Six months into 2021, the global hardwood lumber trade is still recovering from the effects of the pandemic and trade war. In just three years, the U.S. global market share fell by five percent. “But,” Snow reassured, “the good thing is we are creeping back up to 30 percent of all exports of hardwood lumber globally.”

CHINA & HONG KONG

China and Hong Kong have been the main drivers of the declines in U.S. exports. “When we break out and look at the individual markets, the domination of China as a market for our hardwoods becomes much clearer,” Snow said. “One out of every four grade lumber boards in 2018 and 2017 were destined for China, but with the trade war, that changed overnight,” Snow said.

“As recently as 2017 and 2018, we actually exported more to China than we did to the rest of the world combined. By the time we got into 2019 and 2020, that was no longer the case.”

To date, approximately 1.5 billion dollars were lost in sales to China, “which is more than all of our sales of logs and lumber to Mexico, Japan, Vietnam and the EU combined,” Snow said. The OECD expects China’s GDP growth rate to slow from this year’s 8.5 percent rate to 5.8 percent in 2022.

One of the biggest downfalls that AHEC observed with the decline of the Chinese market was with Red Oak exports. “Back in 2017 and 2018, about 80 percent of all Red Oak exports from the United States were destined for China,” Snow said. The export of Red Oak to China has since fallen by 48 percent. In the midst of the trade war, Thailand surpassed the U.S. as China’s largest hardwood lumber supplier. “My guess is that we are probably going to be losing market share even further,” he added.

Behind China, the top-valued export markets are Canada followed by Vietnam and Mexico. Although the value of hardwood lumber exports have increased for these countries in 2021, Snow does not see room for them to absorb the market that was lost from the trade war. “We could quadruple a lot of these other markets and it still won’t reach what we have lost with China.”

“We are still in a situation where the vast majority of our exports are only going to four or five countries, but that is one of the things we are looking at and hoping to change over the next few years,” Snow said.

Log exports have also increased for the U.S.’s top regional markets. “We’ve had a little bit of a comeback with a 14 percent increase (by volume) of log exports in the first six months of this year compared to the first six months of last year,” Snow said. This increase is primarily seen in China’s market, which is “starting to pick up logs again,” according to him.

SOUTHEAST ASIA

The Vietnam market dominates in Southeast Asia, having increased in value by 28 percent in the first half of 2021. But, Snow says, “there is certainly room to grow.”

The market in Southeast Asia is expected to drop in the second half of the year due to the region’s rising COVID-19 cases. “Right now, Indonesia has one of the highest infection rates in the world and Vietnam, Malaysia, and Thailand are not far behind,” Snow said. “In fact, according to one estimate the Vietnamese furniture industry was operating at only 30% capacity in the months of July and August.”

EUROPEAN UNION

The OECD projects the European Union market to grow four to four and a half percent over the next couple of years. In 2020, exports dropped (particularly in the UK), but as of the first six months of 2021, “things are moving in the right direction,” Snow said. “Overall, Europe has weathered the COVID-19 storm fairly well.”

Red Oak continues strong growth in Europe as of the first half of 2021. “We are seeing an awful lot of interest now in Red Oak and I think that’s got to be an encouraging sign for our industry moving forward,” Snow said.

LATIN AMERICA

In Latin America, Mexico remains the greatest export market for hardwood, with a value of just under 100 million dollars annually. “Mexico is one of the few economies that are higher now through the first six months of this year than they were in any of the past years,” Snow said. “As Mexico continues to develop, I think it is going to remain one of the most important markets for us moving forward.”

OCEANA, KOREA, & JAPAN

Taking a look at the developed regions in Northeast Asia and Oceana, AHEC believes there is potential for growth in the Japanese market. “They are still the largest market in that region,” Snow said. “Although, they have been in a slow decline for a number of years now.” The market decline in Japan is partially due to the government’s push for domestic wood products but also the aging national demographic and increased offshoring of manufacturing labor. Despite the drop, Japan remains by far the highest unit value market for American hardwood lumber in the world.

MIDDLE EAST & NORTH AFRICA

In the emerging markets of the Middle East and North Africa, the United Arab Emirates (UAE) remains relatively subdued compared to where it was in previous years. Shipments to the UAE (normally the biggest market in the region) have decreased by 17 percent during the last period. However, other markets have risen due to increased furniture manufacturing in those countries, “so we are starting to see the Middle East come back from where it was in 2020,” Snow said.

India is also an emerging market that is “joining the world economy,” according to Snow. He added that India is projected to continue growing as an importer of sawn hardwood, “India imported over $270 million of lumber last year, but just 1% of that from the US, so there is a ton of headroom for growth.”

AHEC, headquartered in Sterling, VA, is the leading international trade association for the U.S. hardwood industry, representing the committed U.S. hardwood exporters and the major U.S. hardwood product trade associations.

To learn more, visit www.ahec.org.