The year just ended, 2022, was a strong one for most of the participants in this Softwood Forest Products Buyer lumber survey. “Even though we planned on some softening of the market as the year went by, we did not see that in our marketplace other than Industrial grade later in the year,” said one respondent.

Many companies installed new equipment, some of that to make up for lack of employees. One respondent said that shifting gears quickly and responding rapidly to changing conditions was helpful.

A lumber woman stated, “2022 was successful for our company, but the contrasts between ‘21-‘22 are evident. In 2023 we will face many of the same challenges as the industry. The PO’s will not be falling into the laps of the sales team. Anyone hired after 2010 does not know or remember what it is like to work in a tough market. We will have to work hard, add value internally and externally…”

Another company representative said, “…we believe in being extremely proactive in the market, staying ahead of any market shifts and educating our customer base. This allows us all to move into 2023 on a strong footing.”

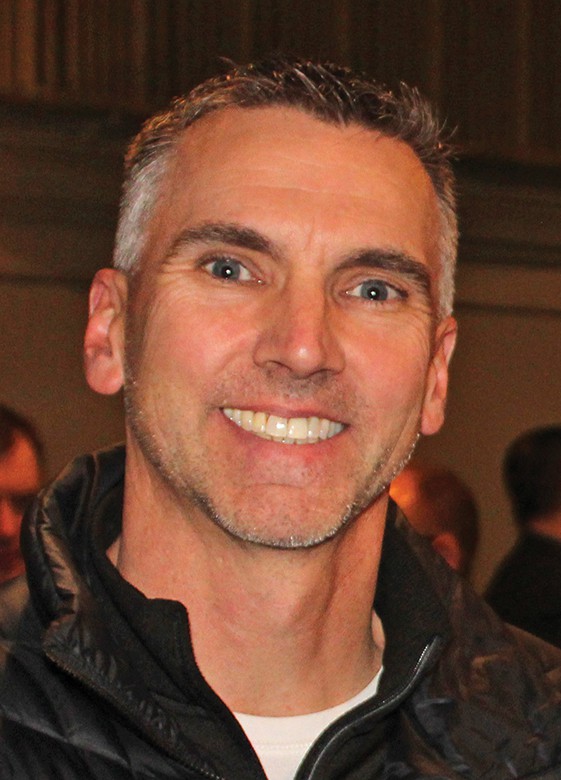

Matt Duprey, Hancock Lumber Co., Casco, ME

2022 was a very successful year at Hancock Lumber. Even though we planned on some softening of the market as the year went by, we did not see that in our marketplace other than Industrial grade later in the year. Hancock Lumber received the Best Places to Work in Maine award for the ninth straight year, our safety performance was strong and our company was able to reinvest into our sawmill business as planned. Hancock Lumber also purchased Madison Lumber in 2022. All of these things, along with a strong market for our Eastern White Pine products, made it a strong year.

2023 will be a challenge. Costs going into 2023 are inflated on top of what were high costs in 2022. Even though our markets are doing well, we expect low-grade markets to continue being a challenge into 2023. Our forecasts along with inflationary pressures on logs and supplies will make 2023’s financials weaker than in 2022.

Our customer base is derived of wholesale and wholesale distribution partners, manufacturers, big box retail, Hancock Lumber Retail and export abroad and in Canada. All of our products were in high demand this year but, no question, it is our pattern program that has been the strongest seller. With moulders at each of our facilities, our pattern programs nationally and internationally represent approximately 45 percent of what we bring to market as a total of our production.

Our product line is still driven to proprietary products and packaging for our business partners. With four mills, our flexibility to market and volume of our production helps enhance growth with our partners in long term programs. This year we have launched our new Hancock Pro Finish line at our Casco location. We are now using state-of-the-art finishing equipment along with the highest technology in coating systems to bring solutions to our customer base. Priming has been our focus year-to-date but we will be launching our staining products in the first quarter of 2023. Stay tuned!

We installed Makor Prefinishing equipment in Casco, which will give us priming and staining opportunities in-house. Also, we installed Comac Auto Graders in our Pittsfield and Bethel sawmills—which allows us to grade lumber, faster and more consistently. We added a PLC tong feeder in the Bethel planer mill which will help through-put efficiencies, decreasing downtime. We also added 10 sorts to Pittsfield’s sawmill drop sorter line which enables us to utilize the Comac Auto Grader to have more sorts to distinguish more grade categories.

With inflation and a strong U.S. dollar, export markets have not been as strong as in years prior. No question, the costs of fiber and the inflated costs of transportation for our export markets have been a challenge in 2022. Domestic transportation has been much better than 2021, but costs are still running at record highs. Availability has gotten better and our approach to transporting our product has helped us gain equipment availability to expedite our product to our customers.

Hancock Lumber’s culture is all about our employees first. Being a nine-time Best Places to Work in Maine and having a culture of everybody leads has really helped us in recruiting and retainment. No question, the job market is a tough place to navigate. But with almost 300 job positions at our mills, we have only 10 openings – a testament for sure to how hard we work to get really good employees and the processes we use to keep them engaged and happy.

Dean Garofano, Delta Cedar Specialties, Delta, BC

For Delta, 2022 was a challenging year. The aftermath of the atmospheric river flood in November 2021 impacted logging roads and flooded inventory for several months. Early in 2022, finding transportation for orders proved to be extremely difficult. With the Cedar market lacking any urgency, prices of logs and lumber declined significantly leaving over-priced inventory. Most of this was out of our control but now that we have a re-set, we are in good position for a more positive 2023.

Our customers are mainly stocking distributors, and this year our strongest sellers were timbers, clears and fascia’s.

We are currently in the middle of installing a new automated trim line and 80 bin sorter at our Halo Sawmill. Completion is expected late Spring, and this will enhance recovery and production.

The transportation issues plaguing us in early 2022 have now dissipated.

Finding new employees with some industry experience continues to be difficult for us, but with things a little slow this winter, we can get by as we work on finding a few key people for 2023.

Tariffs are never a good thing as they make products more expensive for the consumer. The higher value species like Cedar are impacted the most, opening the door up for substitutes.

Brett Slaughter, Elk Creek Forest Products, McMinnville, OR

2022 has been a very successful year. Demand stayed strong for most of the year and inventory turned consistently. Most every challenge is on the table for 2023. A slowing economy with buyer caution and record home prices mean our industry has our work cut out for us. Being able to shift gears fast and react to new things has always provided ECFP ability to navigate the challenges of the past. We will have to do our best work yet in all departments to come out equally as well in 2023.

Large distribution is our biggest customer. We sell a broad product mix with GRN and DRY timbers taking the lead.

We have shifted to better service the multi-family industry with more PET capabilities and larger commodity positions and mixes for jobs.

We have many ideas on equipment in the works but no major changes took place in the year 2022.

Transportation has settled down as an issue mostly with the lack of intensity around demand in the 4th quarter.

Expanding with new personnel is a constant challenge. Future equipment is the plan, and we are thankful for an amazing core team.

Chelsea Zuccato, Patrick Lumber, Portland, OR

2022 was successful for our company, but the contrasts between ‘21-‘22 are evident. In 2023 we will face many of the same challenges as an industry. The PO’s will not be falling into the laps of the sales team. Anyone hired after 2010 does not know or remember what it is like to work in a tough market. We will have to work hard, add value internally and externally, and remind ourselves why Patrick Lumber has stood the test of time for over 107 years and many market conditions. We care about our suppliers and our customers, not only when things are easy, but we show up when things are challenging.

Our hardwood distribution customers were able to get our Clear Douglas Fir rough and finished products more readily available than most other high grade Softwood products. While many other products suffered price increases, lowered availability, and tariffs, Douglas Fir thrived in supply in the Pacific Northwest thanks to domestic mills, and an abundance of fire salvage wood that made Douglas Fir a sustainable and economical choice.

At the mill level, physical labor is always a challenge we are faced with. We continue to offer competitive benefits for all our employees that contend with major companies in our market such as Nike and Intel. We believe we offer some of the best benefits in the industry with 401k matching, PTO, paid volunteer days, healthcare, ICP bonuses; we even pay for subscriptions to applications that offer guided meditation and mental health exercises. We believe that our employees are as important as our customers; we cannot have one without the other.

Also, we installed and tested a Nyle dry kiln controller for our dehumidification dry kiln. It provides a 20 percent reduction on drying hours and increased drying quality. Additionally, we designed and installed a shade dry enclosure utilizing 80 percent reduction cloth which protects product in the green yard prone to checking, splitting and color degradation.

Trina Francesconi, Sandy Neck Traders, South Dennis, MA

2022 was a successful year for Sandy Neck Traders, the best on record to date. We are very fortunate to have great vendor and customer relationships that allowed us to maintain availability of fiber to our established customer base, even during times of supply shortages and uncertain markets. I believe the biggest obstacle we are facing in 2023 is end user hesitation in an uncertain economy, which could potentially hinder sales for our yards and manufacturers. That being said, we believe in being extremely proactive in the market, staying ahead of any market shifts and educating our customer base. This allows us all to move into 2023 on a strong footing.

We sell to independent lumberyards and industrial manufacturers in various industries nationwide.

With supply chain shortages throughout 2022, it was important to offer our customers alternatives in other species and grades of fiber to meet their demand. This has included introducing Alaskan Yellow Cedar to our Cedar offerings, as well as custom milling to allow our customers to free up limited and valuable time during their week.

Transportation remains a struggle, especially during times of outrageous diesel prices. We have been working hard to maintain reasonable freight costs for our customers in this market, and until fuel prices get back to a reasonable rate, will continue to battle this on a daily basis. We are mitigating this with stocking warehouses in other centralized locations to allow for localized deliveries and quick turn-around times.

We are very fortunate to have a skilled and loyal workforce, most of our employees having been with us for many years. Because of this, we have not experienced the struggle with hiring and retaining team members that seems to be occurring elsewhere.

Jeff Bowers, Bowers Forest Products Corp. Beavercreek, OR

2022 was a successful year. The year started off great and ran hard until things started slowing down in July. July was the first month in several years that we didn’t run OT. Still, to date, we have kept everyone working 40 hours a week and anticipate this will hold for the rest of the year.

Our biggest challenge for 2023 will be the work force. We have every other aspect working well. We will just be short on employees.

Our customers are a mix of industrial, distributors and retail. All of our products sold well all year.

We installed a new moulder in 2022. We are now offering Cedar deck balusters, furring strips and tongue-and-groove boards.

Over-the-road freight got really expensive this year. I stopped using rail because the service was too slow and unreliable. Christmas tree season is causing its usual problems.

We are short on employees and have been all year. Next year will be worse. We are investing in as much automation as we can.