The SLB’s Strategy For 3 Billion Board Feet Of New Annual Lumber Demand

Credit: Shopworks Architecture

Since 2012, the Softwood Lumber Board has focused on its mission to increase demand for softwood lumber through work in code, conversion, communications, and education—with more than 15 billion board feet (BBF) of incremental demand generated since 2012, a return of 86 board feet for every dollar invested. This work has been critical to market growth: Without the SLB, annual softwood lumber use from 2020-2024 would have been 3.5 percent lower.

The SLB has a proven track record of developing transformative strategies and executing programs that advance growth for the lumber industry. Complementary work streams led by SLB-funded programs, the American Wood Council, Think Wood, WoodWorks, and Education, focus on creating, defending, and implementing codes and standards, amplifying design and construction best practices, inspiring innovation in new performance applications, and providing technical solutions to challenges for specifiers and contractors.

As the markets shift, the SLB and its funded programs must continue to evolve and optimize strategy, priorities, and tactics. Innovations such as mass timber create major opportunities, but competing industries aren’t giving up their market share without a fight. In other words, the bar for success has been raised. To realize this opportunity, the SLB has developed a concentrated strategy that expands lumber’s role in the built environment with a goal to attain 2.9 BBF of incremental annual lumber demand by 2035.

Prioritizing Highest-Impact Segments

To position the wood products industry for its next evolution of success, the SLB will capitalize on more than a decade of market-building to expand lumber’s role in the built environment from niche to mainstream. The SLB will prioritize high-growth segments, where lumber and building systems already hold strong value propositions, that can be leveraged for faster adoption.

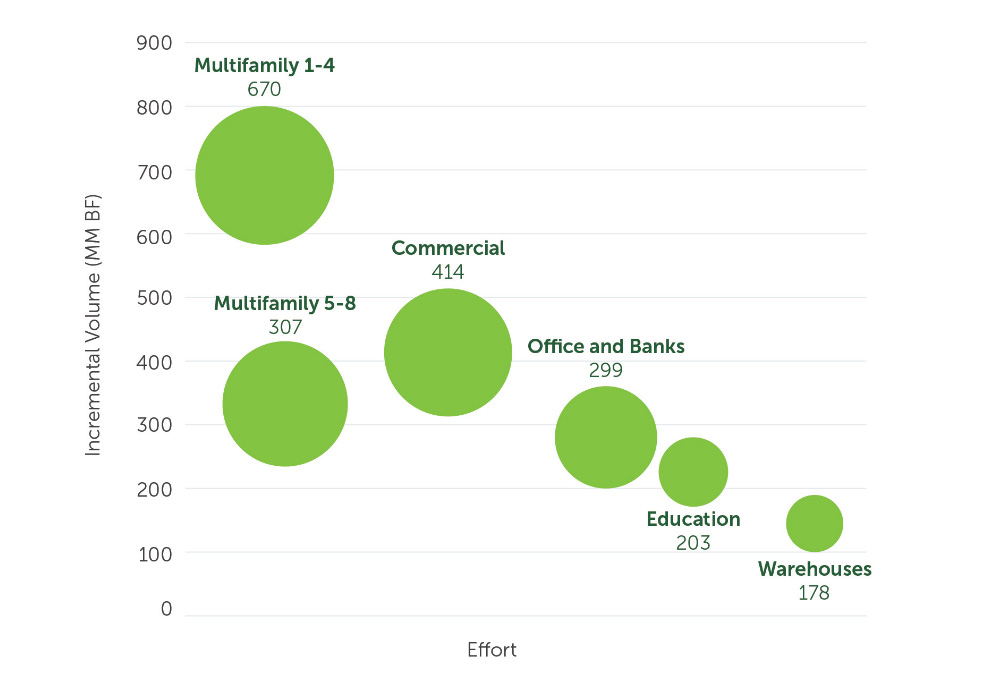

The SLB will prioritize high-impact segments, with annual incremental volume opportunity shown in millions of board feet.

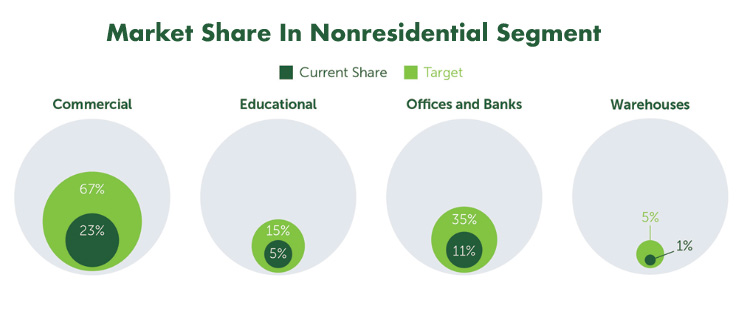

Based on work that the SLB commissioned from the Forest Economic Advisors, subsegments of the residential and nonresidential segments including multifamily, affordable housing, education, and warehouses and distribution centers present the greatest opportunity for demand generation. Market share growth in these segments is achievable within the current scale of the industry’s investment in the SLB.

Lumber building systems have the potential to reach taller building heights in both multifamily and nonresidential. Projects such as Sacramento’s 1430 Q are taking light-frame construction as high as 8 stories, and the proposed 55-story Marcus Center mass timber skyscraper in Milwaukee would more than double the height of Ascent, today’s tallest hybrid timber tower. The added potential for light-frame and hybrid construction, ideally light-frame and mass timber, compounds the opportunities available for incremental volume across the segments, subsegments, and building types.

The Path to +2.9 BBF

To reach 2.9 BBF of incremental volume by 2035, the SLB will build on the success of current programs in primary market segments, continue to reduce barriers to wood construction such as code and insurance, focus investments to further the cultivation of priority target audiences, support industry efforts that align with the mandate, and form alliances to enter markets where competing materials currently dominate.

The plan drives growth by building on what’s already working and reaching more of our target audience in a more effective way. The flexible approach focuses on constant improvement and quickly adopting new ideas to deliver strong, scalable results.

The 180,000-square-foot JJ Carroll Redevelopment provides 142 affordable housing units for seniors with five stories of light-frame construction over a concrete podium. Credit: MASS Design Group

Protecting Wood’s Future

The construction industry faces challenging economic headwinds, and material competitors are working aggressively to challenge wood’s environmental and performance advantages. Competing industries are making claims about their own materials’ carbon footprint and resilience, backed by well-funded marketing campaigns.

Competitors are also claiming that lumber is especially prone to tariffs, although all structural materials import elements of their product. In the 2027 building code development cycle, competitive industries are attempting to roll back provisions from the 2024 codes that make mass timber more appealing and valuable to developers.

By advancing a purposeful and strategic vision to protect and grow market share, the SLB has created a path to further gains in codes, education, and demand—but maintaining this momentum requires continued industry support.

The SLB team is committed and focused on the delivery of fundamental programs proven to retain market share and pave a clear path to increase demand in the U.S. market—so that every business relying on that market can thrive. The visionary leadership of the softwood lumber industry, paired with strategic thinking, financial stewardship, and the results-driven focus of the SLB, positions the industry to achieve its aim of moving lumber-based construction from niche to mainstream in the built environment.

The support and financial investment provided by the lumber industry for nearly 15 years helped the softwood lumber industry and wood products capture substantial new demand. This commitment to a shared vision of growth has shown remarkable foresight—and the SLB’s future strategy represents the next evolution in that long-term approach to building market strength.