President, Softwood Export Council

(www.softwood.org)

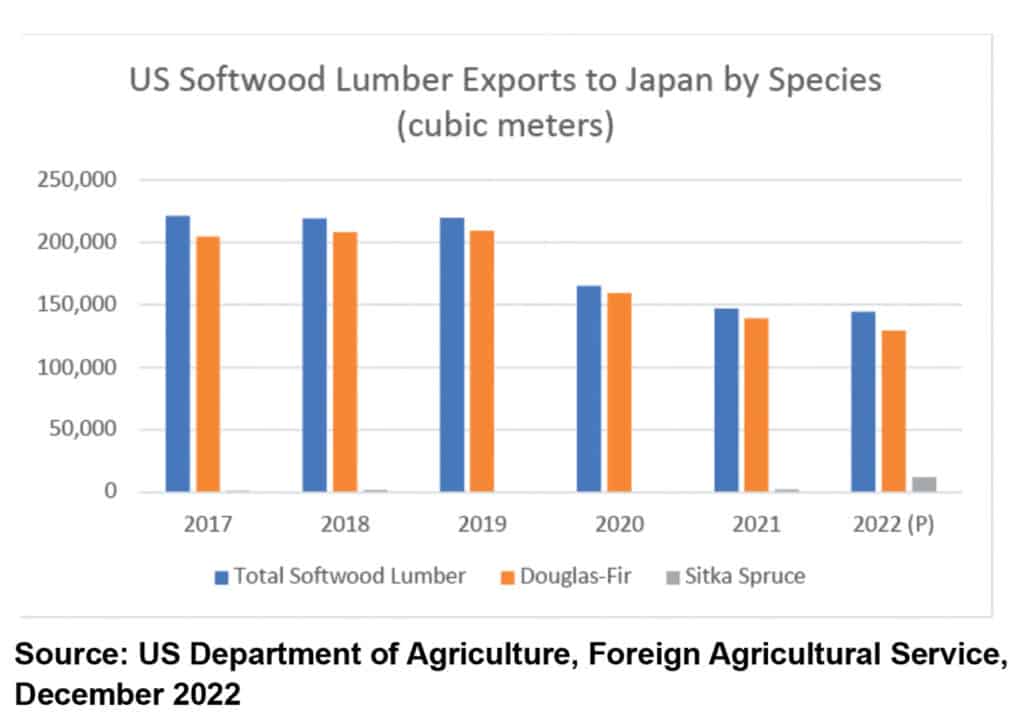

In December 2019, I presented an update on the U.S. lumber market at a Japan Lumber Importers Association meeting as part of an SEC’s annual exchange to connect U.S. Softwood lumber suppliers and Japanese importers. The changes in the U.S. market in just three years are striking and they underscore the importance of international market diversity for U.S. Softwood lumber suppliers.

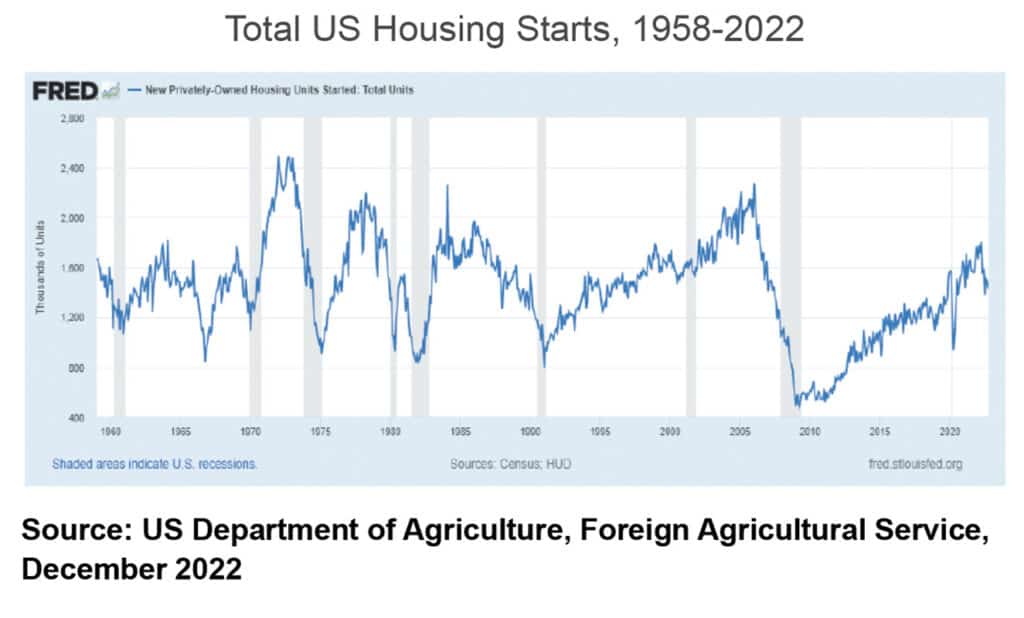

In 2019, U.S. housing starts were still recovering from the 2009 global recession, repair and remodeling expenditures were down, and the Western SPF 2×4 composite price was $379 per thousand–far below a May 2019 peak of $582. At the mill level, U.S. production was flat and mills in BC were curtailing production. The positive news at the time was that the Western SPF 2×4 composite price was projected to reach $407 per thousand during first quarter 2020. Due to a housing shortage, home equity levels were high, and unemployment was low, which bode well for projected growth in spending on repair and remodel projects.

Who could have imagined that six months later, lumber prices would surpass $1,400 per thousand and homeowners, armed with time on their hands and equity in their homes would cause a repair and remodeling surge of a level never seen before? After a very short drop in lumber production in keeping with COVID restrictions, U.S. producers focused on increasing production and supplying surging U.S. demand. Although international demand was also high, record high container rates and U.S. lumber prices, coupled with port slowdowns affected U.S. suppliers’ ability to compete in international markets – nor were most interested. Fast forward to February 2023 and the U.S. market is again slowing as the lending rate surpasses 7.7 percent, 2022 inflation is at 7.7 percent over this time last year, and housing affordability is at the lowest level since 1989.

While U.S. demand during the COVID years was unprecedented, international diversification is vital to long term stability for U.S. lumber manufacturers. Market fluctuations are a constant, and the importance of international markets was clearly evident when the 2007 global recession hit. In 2007, U.S. forest products exports reached $5.2 billion – $698 million of which was Softwood lumber. U.S. Softwood lumber exports continued to increase in subsequent years while domestic lumber consumption declined 33 percent. Although exports account for a small share of U.S. lumber production, for the hundreds of small, often family-owned lumber mills and wholesalers across the country, exports meant they could continue to operate in the black, retain employees, and outlast the downturn.

Exports are also important for large corporate lumber producers who must find new markets for large volumes of lumber coming online. This means creating new international markets – both geographically, and in terms of developing new innovative ways to expand consumption.

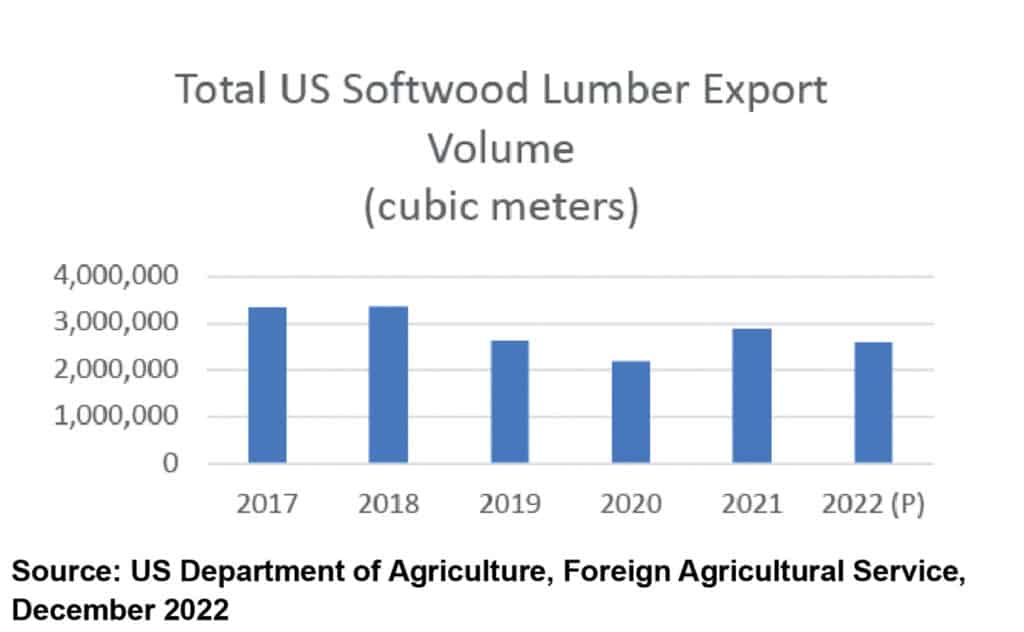

Exports Return as U.S. Prices and Shipping Rates Decline

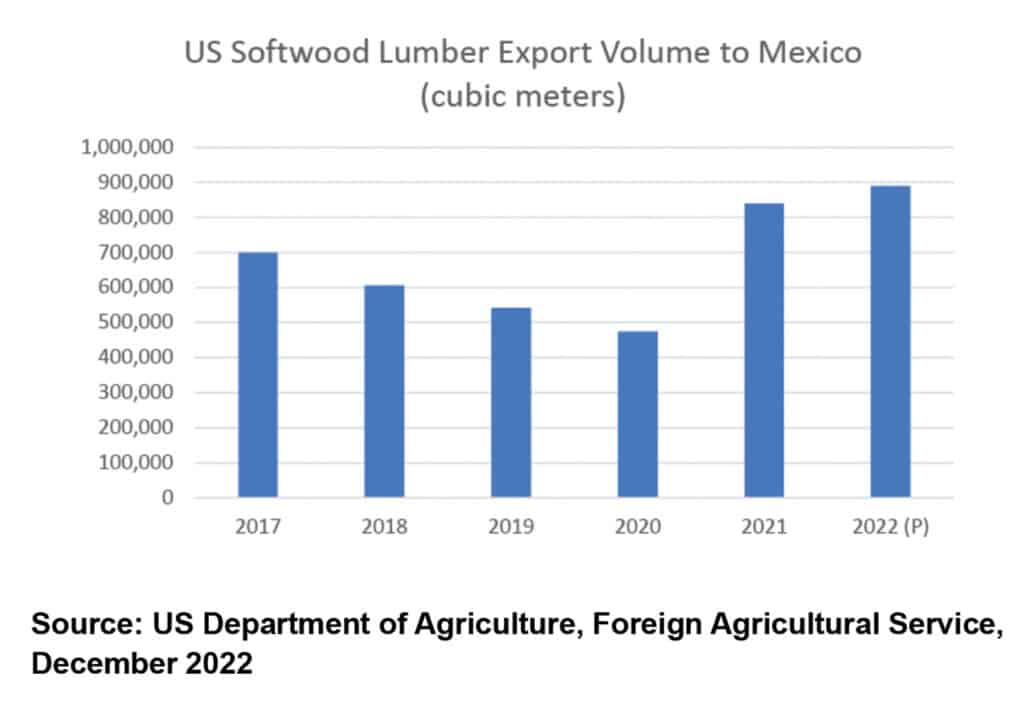

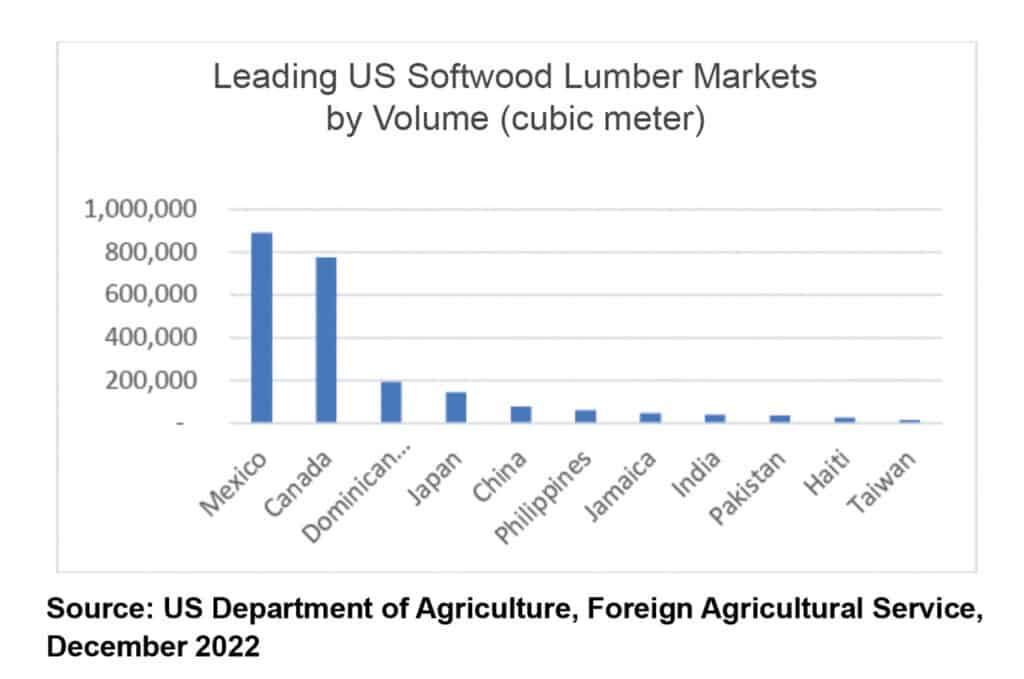

U.S. exports have almost returned to pre-COVID levels. Mexico replaced China as the leading market for U.S. Softwood lumber with almost 900,000 cubic meters valued at $286 million projected for 2022. U.S. suppliers to Mexico benefit from increased nearshoring from international manufacturers, the U.S.-Mexico Free Trade Agreement (USMCA), a shared border, and U.S. phytosanitary regulations which require heat treated material for pallets entering the U.S. from Mexico. The USMCA also requires that a portion of all wood furniture imports from Mexico include a portion of U.S. material.

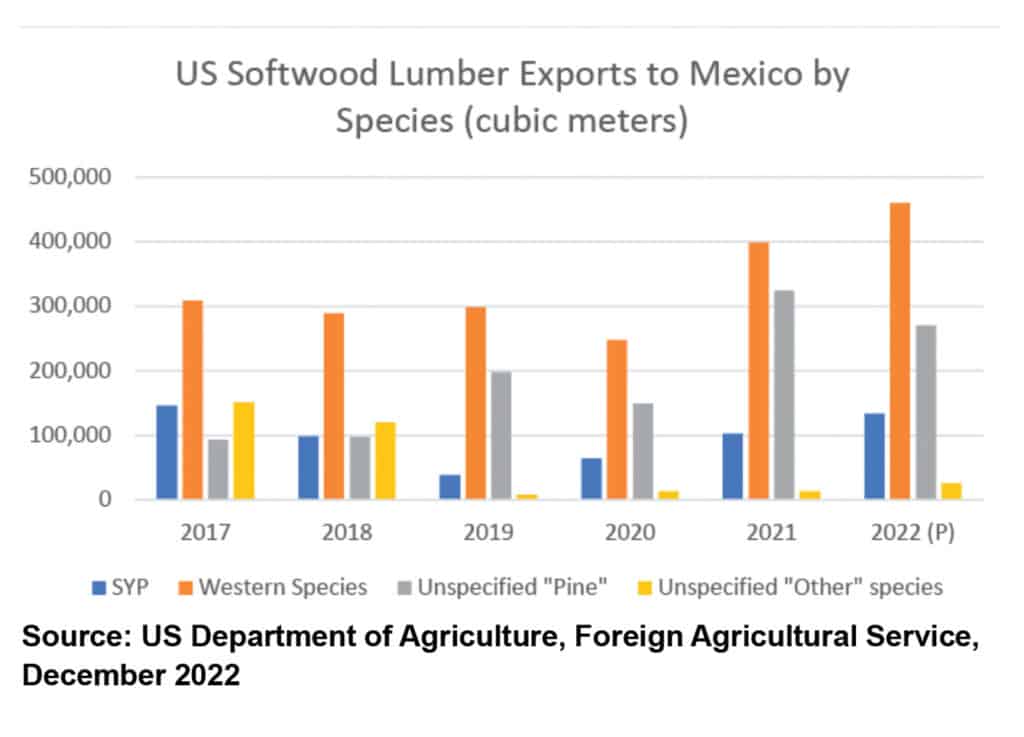

Much of the lumber shipped from the U.S. to Mexico is used in pallets, and while Mexican producers prefer dimensions supplied by South American producers, the U.S. suppliers benefits from lower rail costs and a preference for U.S. lumber quality and species. As shown in the figure below, on a volume basis, Western species make up over 50 percent of the Softwood lumber shipped from the U.S. to Mexico.

Asia is the leading region to watch with the world’s fastest growing population and the fastest growing number of middle class and wealthy consumers in the world. In 2022, 60 percent of the world’s population, or 4.5 billion people, resided in Asia. By 2050, analysts project that this number will grow 5.6 billion.

Analysts also project that by 2030, 65 percent of the world’s middle class will reside in Asia, up from 54 percent in 2020. In response to this trend, as well as the importance of Southeast Asia as a manufacturing center, SEC participates in several trade shows throughout the region and holds trade missions, educational seminars, and U.S. supplier and buyer exchanges in Vietnam and Thailand. The association is also investigating new opportunities for U.S. suppliers in Cambodia and northern Vietnam, both emerging manufacturing hubs.

In 2023, SEC will organize booths at 12 international trade shows and lead trade missions to Mexico and Vietnam–all of which are available to U.S. Softwood lumber suppliers. To learn more about these events and the SEC, visit www.softwood.org.