JJ Carroll Redevelopment. Credit: MASS Design Group

https://rethinkwood.filecamp.com/s/d/pqR0RvJOWGUAuNJM

Wood is by far the preferred structural material for construction in low-rise residential construction. In the United States, 93% of single-family homes are framed with dimensional lumber, as are up to 90% of apartment buildings of 4 stories or less. To provide a sense of scale, housing represents on average 3 billion square feet of new construction annually in the United States. Housing is where lumber has thrived historically.

Just beside homebuilding lies another construction story that’s in stark contrast with these figures: Another 1 billion square feet of construction each year consists of nonresidential and higher-rise residential buildings that are typically framed using other materials. In 2023, wood accounted for only 8% of nonresidential construction buildings 1 and 1% of multifamily buildings with 9 or more stories. If housing is where lumber has thrived historically, the nonresidential space is where it remains encumbered by building codes, practitioner knowledge, and competitive forces.

Lumber offers compelling advantages over traditional building materials like steel and concrete. It’s a renewable resource, stores carbon, and contributes to beautiful indoor environments. When it is left exposed, occupants enjoy being surrounded by a natural material. As the construction industry increasingly prioritizes sustainability, wood emerges as a preferred option.

These benefits, combined with the substantial construction activity where wood could be used, form a tremendous opportunity to improve the sustainability of the built environment. We at the FEA believe that the transition to increased wood use is already well underway. With the support of efforts by the Softwood Lumber Board and its funded programs—WoodWorks, the American Wood Council (AWC), Think Wood, and SLB Education—light-frame construction is making further inroads into midrise, multifamily construction, and mass timber is transforming the construction industry at an unprecedented pace.

Multifamily Construction, in Response to the Housing Deficit

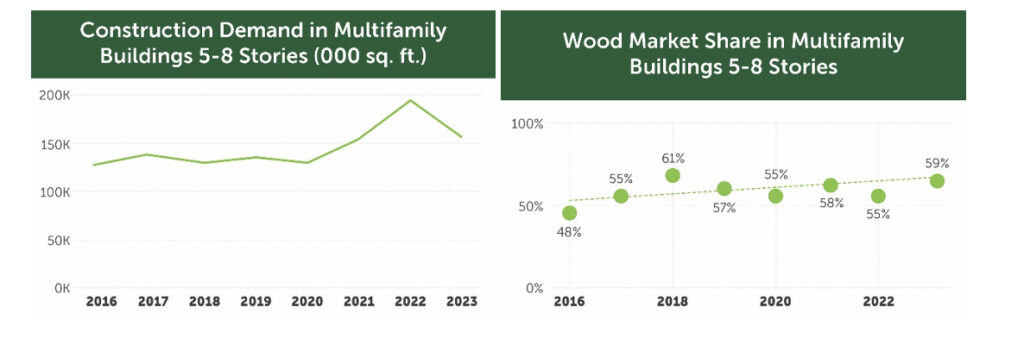

Midrise, multifamily construction includes buildings between 5 and 8 stories. It’s a segment with major potential. With the massive housing deficit in the U.S. market (estimated at 4 million units), the market share for multifamily units is bound to increase from 27% of housing starts in 2025 to a projected 37% in 2040. The Figure below exemplifies the forces at stake, with construction demand growing and with wood increasing market share.

Mass Timber, a Revolution in Construction

Mass timber is used in various forms, with glued-laminated timber (glulam) and cross-laminated timber (CLT) being used together in most massive wood buildings. Because the industry is still in early stages, mass timber designs are still being optimized, and designers are implementing myriad innovative framing systems. For instance, the combination of steel with mass timber has gained significant traction in just the last few years. Meanwhile, the combination of CLT elements for floor systems within light-frame apartment buildings is spreading across North America.

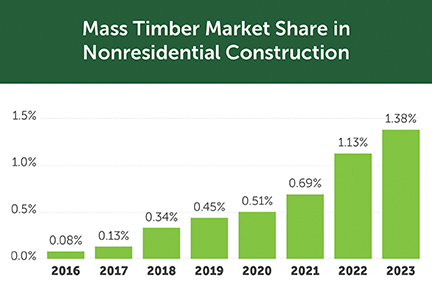

Since its inception some 15 years ago, mass timber is by far the fastest growing structural material across the entire construction market. In nonresidential construction, the market share for mass timber has grown threefold between 2019 and 2023. (Graphic below). There is significant opportunity for growth ahead for lumber, mass timber and hybrid buildings to alter and improve construction practices. At current pace, CLT manufacturing could well consume over 1 billion board feet of lumber by 2035.

Where to from Here?

The billion square feet at stake for wood construction is not a single, uniform market. It is rather made of several widely diverse segments, the most promising of which include:

- Mid-rise multifamily (5-8 stories): This segment is well-suited for both light-frame and mass timber construction. Increased wood use can help address housing affordability and supply challenges.

- High-rise multifamily (9+ stories): Although current market share is low, recent code changes allowing taller mass timber buildings have unlocked immense potential in this segment.

- Educational buildings: With a low current wood market share (5%), this segment offers substantial room for growth, especially given the emphasis on sustainability and occupant well-being in school construction.

- Offices and banks: This segment has shown consistent growth in wood market share, and further expansion is possible. People love working in wood-based environments, inspired by nature.

- Commercial buildings: Mostly comprising one or two-story structures, this segment is ideal for light-frame construction.

- Warehouses: While currently dominated by other materials, warehouses represent a large potential market for wood construction. Larger buildings such as warehouses call for innovative solutions. The growing segment of data center construction is a perfect fit for wood solutions.

A Future Built with Wood

Lumber can lead the way toward a more sustainable built environment, and the potential for its use in multifamily and nonresidential construction is tremendous. On average, these segments currently require 4.9 billion board feet of lumber annually. Looking forward, an equivalent volume is at stake through continuous efforts in developing the wood design and construction culture, in supporting the evolution of codes and standards, and in expanding manufacturing capabilities.

The SLB has worked closely with FEA to understand and analyze these market opportunities, and it’s developing a vision for future growth aligned with the efforts needed to grow lumber’s market share. With continued industry support, these efforts help to ensure a future built environment increasingly framed with wood.

1 – We exclude manufacturing facilities from this analysis.