By Robert Dietz, Ph.D.

Chief Economist and Senior Vice President for Economics and Housing Policy for National Association Of Home Builders

(The following is re-printed from the NAHB’s Eye on Housing economics blog.)

The Federal Reserve has supported the housing market during the virus crisis, the 2020 recession, and the subsequent, ongoing recovery via asset-backed purchases (among other tools), including $40 billion a month of mortgage-backed security (MBS) purchases. These MBS purchases have held interest rates lower than they otherwise would have been.

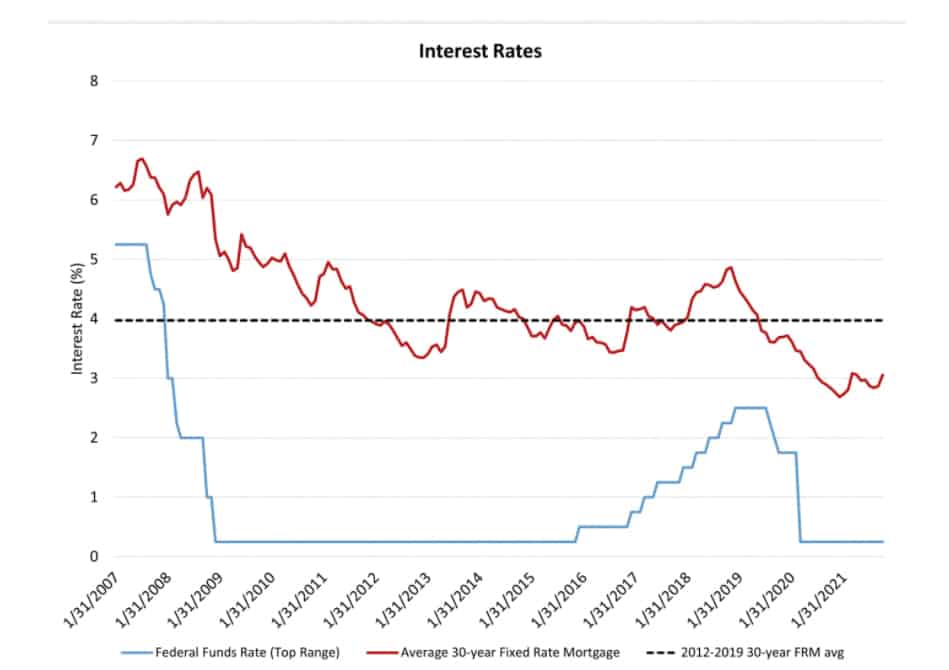

In November, the Fed reduced the monthly volume of such purchases by $5 billion a month. Further, the Fed will reduce by $10 billion a month its purchases of Treasuries (currently at $80 billion a month). These actions will put some upward pressure on interest rates, which NAHB forecasts will reach 4% for the 30-year fixed rate mortgage during 2023. The Fed may adjust this pace of tapering as economic conditions warrant. However, if this pattern were to hold, then asset purchases will cease by mid-2022.

The Fed has telegraphed these actions over the last few quarters in order to avoid a quick jump in interest rates, as happened in 2013 during the so-called “taper tantrum.”

The Fed also held its target for the federal funds rate steady. When the first-rate hike occurs is a matter of speculation at this stage, although the announced schedule of tapering suggests an initial rate increase during the second half of 2022 (perhaps after the 2022 election?). On net, this leaves the Fed in a broadly accommodative policy stance, supporting the economy.

The Fed adjusted, slightly, its inflation outlook. In its statement, the Fed noted:

“Inflation is elevated, largely reflecting factors that are expected to be transitory. Supply and demand imbalances related to the pandemic and the reopening of the economy have contributed to sizable price increases in some sectors.”

The “expected to be” in the statement may be a hedge to the possibility that despite a majority of economic forecasts envision the growth rate of inflation cooling during 2022, some persistent, elevated inflation may last into 2023 due to the impacts of stimulus and ongoing supply-chain challenges.

The inflation outlook is being driven by opposing short-run and long-run forces. In the short-run, supply-chain bottlenecks and pressure from a reopening of the economy is increasing inflation. However, long-run factors favor lower inflation, due to demographics (an aging population), global trade, and technology. Moreover, growth expectations have cooled recently. The winner of these countervailing inflation trends will determine the future of mortgage interest rates, which is critical given the more than 30% gain in home prices since January 2020 and declines for housing affordability.

About the author:

Robert Dietz, Ph.D., is Chief Economist and Senior Vice President for Economics and Housing Policy for NAHB, where his responsibilities include housing market analysis, economic forecasting and industry surveys, and housing policy research. Dr. Dietz has published academic research on the private and social benefits of homeownership, federal tax expenditure estimation, and other housing and tax issues in peer-reviewed journals, including the Journal of Urban Economics, Journal of Housing Research, the National Tax Journal and the NBER Working Paper series. He has testified before the House Ways and Means Committee, the Senate Finance Committee, and the Senate Banking Subcommittee on Economic Policy on housing and economic issues. Prior to joining NAHB in 2005, Robert worked as an economist for the Congressional Joint Committee on Taxation, specializing in revenue estimation of legislative proposals involving housing, urban development, and other business tax issues. He is a native of Dayton, Ohio and earned a Ph.D. in Economics from the Ohio State University in 2003.