At the recent Indiana Hardwood Lumbermen’s Association Convention in Indianapolis, IN, American Hardwood Export Council (AHEC) Executive Director Michael Snow gave a detailed analysis of the current export markets for U.S. hardwoods. Similar to the domestic market situation, 2021 proved to be a very good year for hardwood lumber exporters. Pent-up consumer demand in the housing and renovation sectors around the globe led to significant gains in many markets as people upgraded the homes where the pandemic was forcing them to spend an increasing amount of time. Overall exports of hardwood lumber increased by just over 8 percent by volume, but 25 percent by value reflecting the dramatic increases in prices for nearly all U.S. hardwood species, cementing the U.S. position as the world’s largest hardwood exporter.

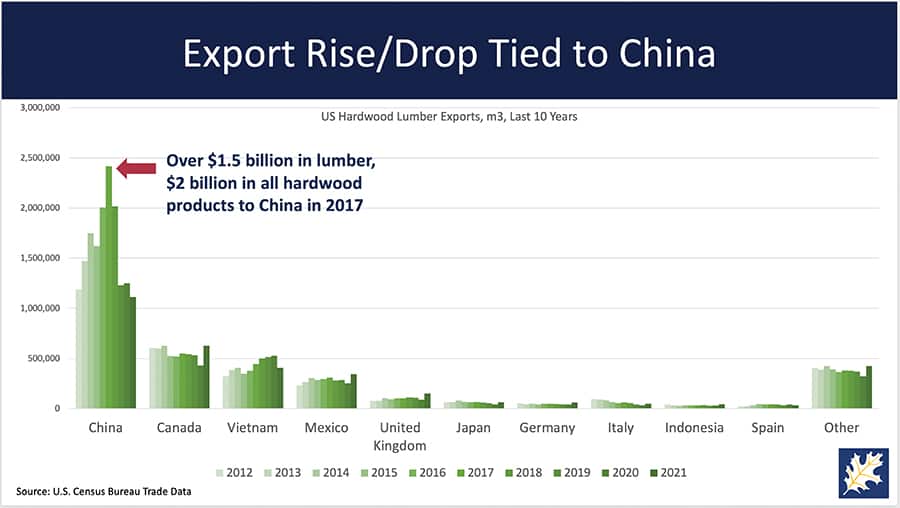

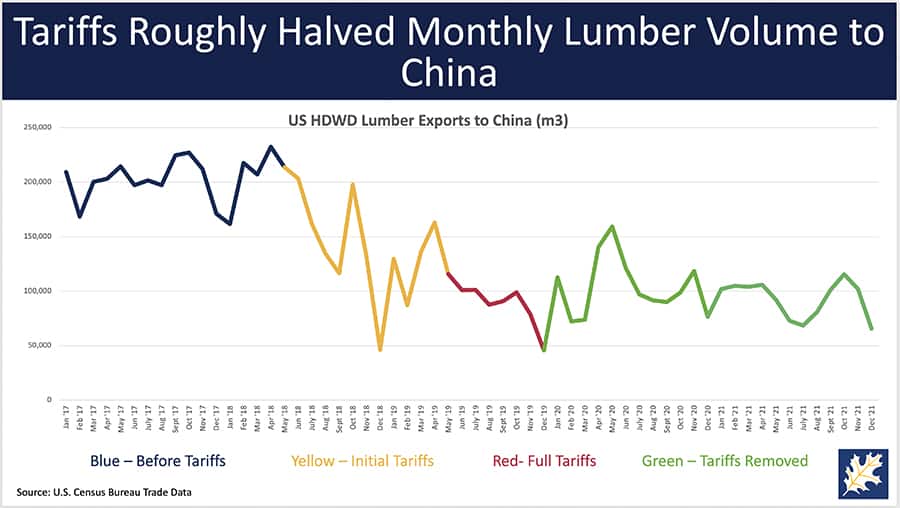

The 2021 increase represents a return to pre-pandemic levels of exports, but still falls well short of the pre-trade war years of 2017-2018. This is the result of an overdependence on China, which is by far the world’s largest importer of hardwood lumber and remains the largest destination for U.S. exports. Nevertheless, exports to China by 2021 seem to have stabilized at roughly half the pre-trade war volumes. Not all of this can be blamed on the trade war, however, as China’s imports from all sources have also declined over the past three years. A slowing economy, COVID pandemic impacts on supply chains and a looming debt crisis in China’s housing and construction industries–where several large developers are facing insolvency–are all contributing to reduced demand.

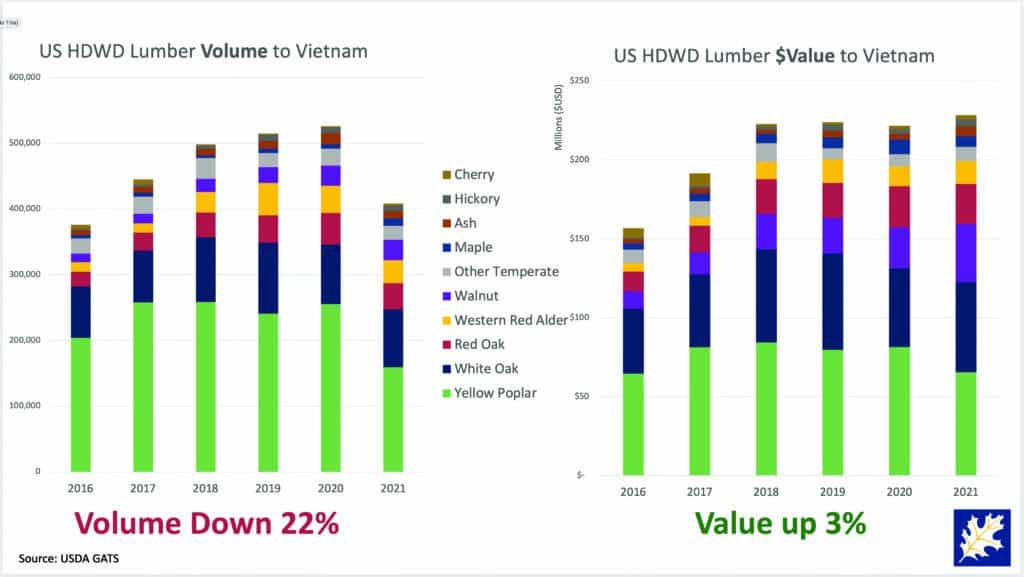

After China and Canada, the next largest single market for U.S. hardwood lumber exports is Vietnam, which has a dynamic furniture sector heavily focused on exports. Vietnam has suffered severe disruptions from COVID related shutdowns, however, and through much of last summer by some estimates furniture plants in the country were operating at less than 30 percent of capacity. Against that backdrop, it is not surprising that Vietnam’s imports of U.S. hardwood lumber declined by 22 percent in 2021, although on a value basis it actually increased by 3 percent over 2020 totals. This is the result of not only higher prices for lumber, but also a noticeable shift toward more valuable species such as Oaks and Walnut and away from the previous dominance of Yellow Poplar as Vietnamese furniture manufacturers move up the value chain.

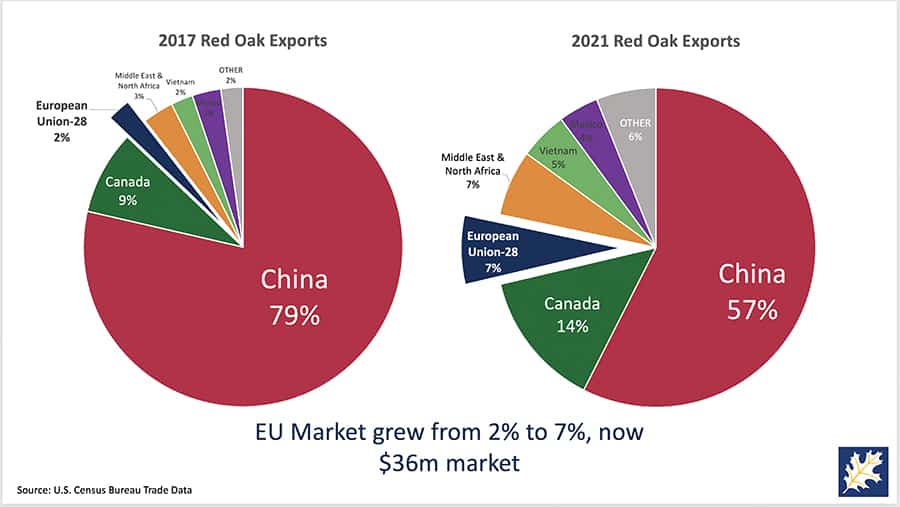

Snow also highlighted several positive trends from East Asia and the Pacific Rim as Japan, South Korea, Australia and New Zealand not only returned to pre-pandemic levels in 2021, but all four countries actually surpassed volumes going all the way back to 2016. In addition, all four countries have expanded their species mix which have historically been dominated by White Oak. Red Oak is making significant inroads which is a welcome development given the declines of Red Oak exports to China which as recently as 2017 accounted for nearly 80 percent of all U.S. exports of the species. Snow pointed out that over the past several years AHEC has been focusing a considerable portion of its promotional budget on species that have been underutilized in exports such as Red Oak, Cherry and Maple.

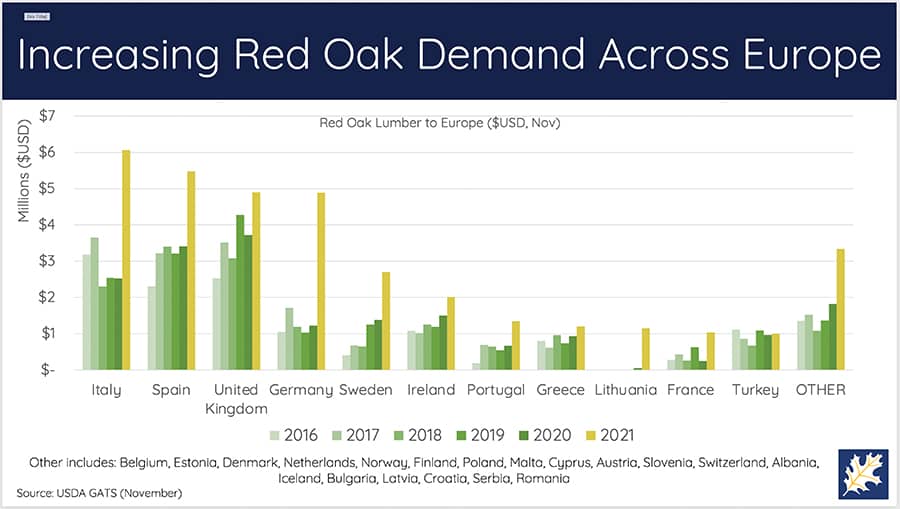

This “Red Oak renaissance” can also be seen in the European Union where the species has made considerable headway over the past few years, and particularly in 2021. All major EU countries plus the United Kingdom saw strong Red Oak growth, and with the notable exception of Spain all major EU countries saw solid growth in their overall American hardwood imports last year.

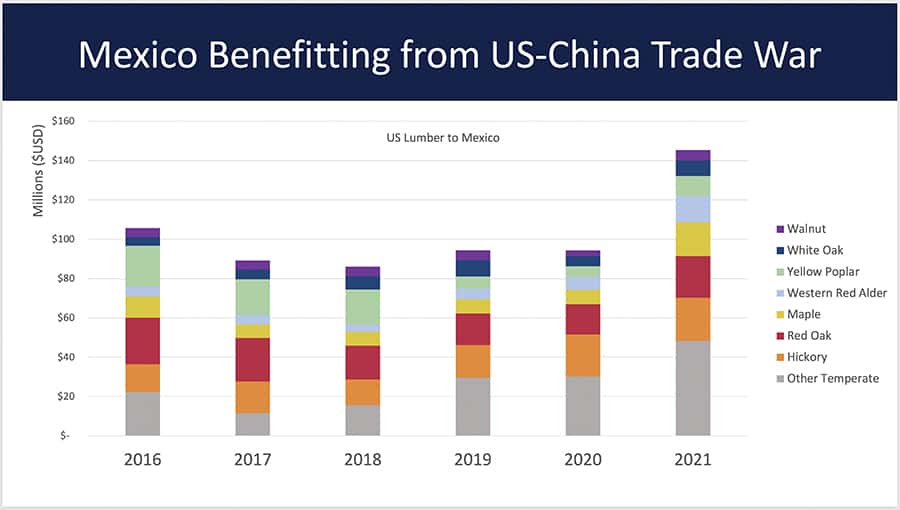

Mexico also proved to be a bright spot in 2021, as U.S. hardwood lumber exports grew 35 percent by volume and a whopping 53 percent by value. This was despite the heavy toll that COVID took on the overall Mexican economy and is largely the result of pandemic supply-chain disruptions from Asia and the U.S. trade war with China which is driving momentum to return some production to North America through “near-shoring.” Mexican produced goods have unfettered access to the vast United States market because of the U.S.-Mexico-Canada Free Trade Agreement (USMCA) and the country stands to be perhaps the largest beneficiary of continued trade tension between the U.S. and China.

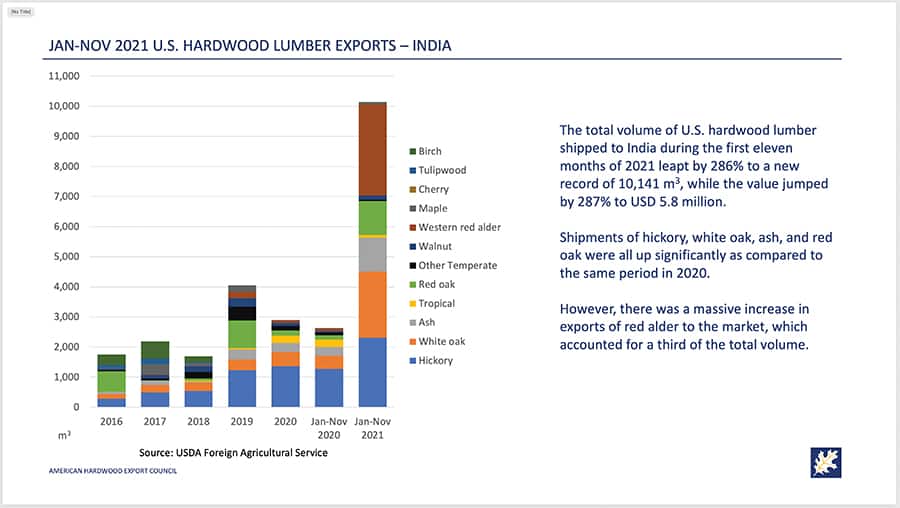

Finally, Snow wrapped up his presentation by highlighting the potential of India—soon to be the world’s most populous country. After several disappointing years of exports the needle began to move visibly in 2021 as the total volume of U.S. hardwood lumber shipped during the first eleven months leapt by 286 percent to a new record of 10,141 m3, while the value jumped by 287 percent to USD 5.8 million. This still represents only about 3 percent of India’s total hardwood lumber imports so there is still much work to be done but the potential cannot be ignored.