Tariffs & Opportunity: What The Lumber Industry Needs To Know – Your Quick Guide To The New Reality

(Provided by the National Hardwood Lumber Association)

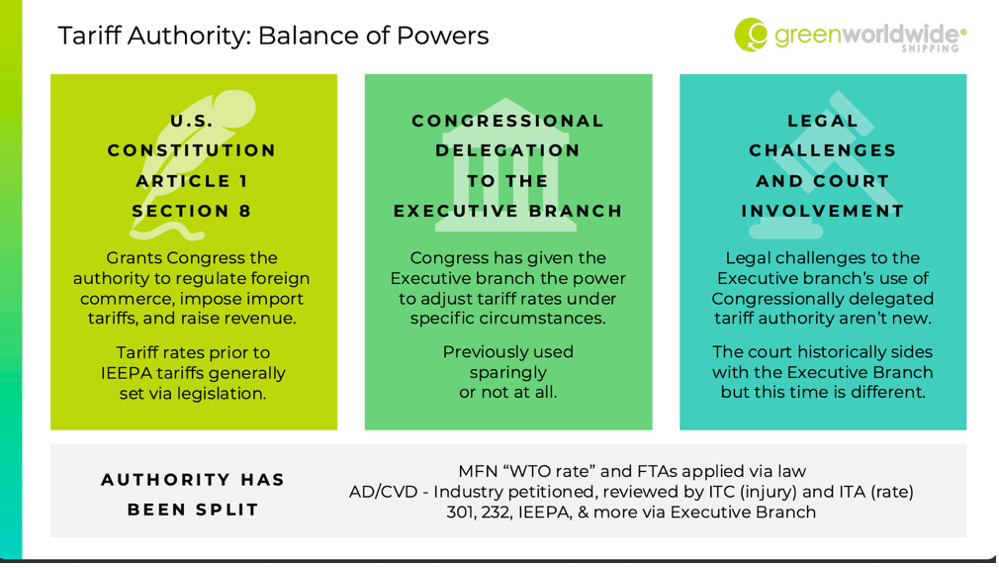

The tariff climate is shifting fast — and your bottom line could be next. On September 17, NHLA hosted a high-impact webinar designed to give members a competitive edge. Kate Rayer, Vice President of Regulatory Services at Green Worldwide Shipping, drew on 20+ years of customs and compliance expertise to explain who controls tariffs,

why new investigations matter, and what hardwood businesses should do right now.

Rayer highlighted a national security investigation into lumber, timber, and related products with results due in November, which could trigger new tariffs or quotas. She also noted that tariffs on Chinese goods—currently at 10 percent—could jump back to 34 percent if no new deal is reached.

Adapted from Kate Rayer’s presentation, this slide shows which branch of government sets, applies, and reviews tariffs—making it clear why policy can change quickly and why upcoming court rulings matter.

Section 232: From Investigation to Action

At the time of the webinar, a national security investigation into lumber, timber and related products was still underway. Since then, the White House has issued a proclamation (September 29, 2025) formally imposing new tariffs under Section 232.

Beginning October 14, 2025:

• Softwood imports will be subject to a 10 percent duty.

• Upholstered wood products will be subject to a 25 percent tariff, increasing to 30 percent in 2026.

• Kitchen cabinets and vanities (and their parts) will face a 25 percent tariff, jumping to 50 percent in 2026.

While the order primarily targets softwood and finished goods, these shifts could reshape hardwood markets through altered trade flows, retaliatory actions abroad, and increased pressure on global supply chains.

Tariffs on Chinese goods also remain a moving target — currently at 10 percent but subject to increase depending on negotiations.

What the Numbers Are Telling Us

According to AHEC’s mid-year 2025 report, U.S. hardwood exports are undergoing a major shift:

• China’s purchases keep falling — down 11 percent compared to 2024.

• Vietnam’s demand is rising — $112.5 million in the first half of 2025.

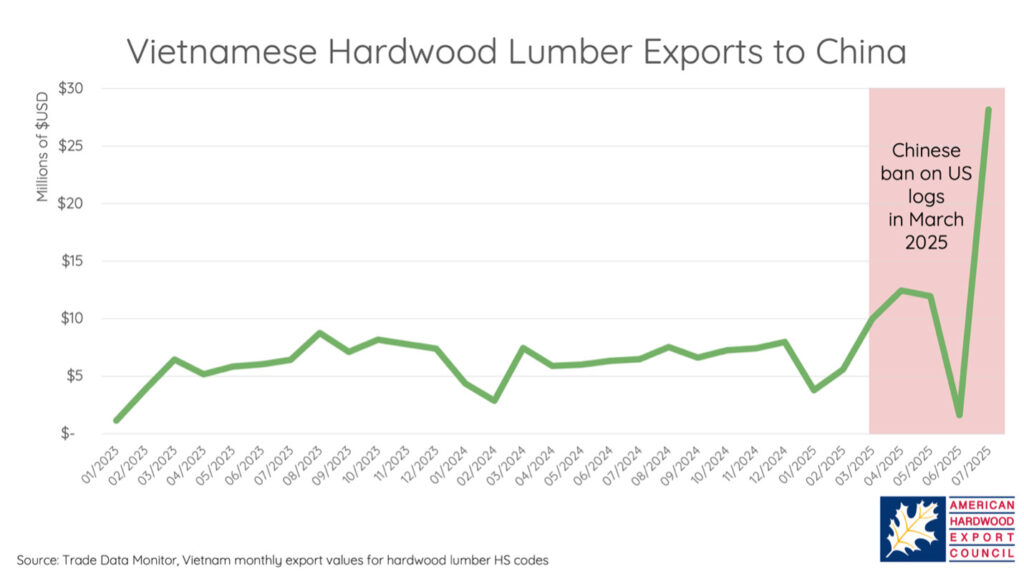

The graph highlights China’s decline and Vietnam’s growth, underscoring why exporters must diversify across markets.

China’s Log Ban and Its Ripple Effects

The March 2025 log ban in China remains one of the most frustrating challenges for the hardwood sector. In a recent conversation with Tripp Pryor, International Program Manager at AHEC, he confirmed that China’s General Administration of Customs (GACC) cites invasive pests like bark beetles and longhorn beetles as the reason for the ban but has offered no specific plan or timeline for resolving the issue. The ban surprised both U.S. and Chinese industries and, despite a strong outcry, there has been no sign of softening.

Courtesy of AHEC, this graph shows the sharp increase in Vietnamese shipments to China following the ban,

proving that demand for U.S. hardwood is still strong—just rerouted.

“The log ban is an unfortunate and frustrating issue for the industry,” said Pryor. “GACC maintains the ban is due to invasive pest concerns; however, they have not provided a roadmap to fix these issues.” Efforts by the United States Department of Agriculture’s Animal and Plant Health Inspection Service (USDA APHIS), the Department of Commerce, and industry groups to open talks have so far been unsuccessful, as China has not engaged. The timing of the ban has led many to believe that political considerations also played a role.

As a result, sawmills have rapidly been established in Vietnam, many staffed with Chinese workers, to process U.S. logs and ship lumber and dimension products back to China. Vietnamese exports of hardwood lumber to China have doubled since the ban — jumping from an average of $6M per month (Jan 2023–Feb 2025) to over $28M in July 2025.

Strategies To Keep Your Business Competitive

Rayer urged members to make use of three key programs that can protect cash flow and improve competitiveness:

• Duty Drawback – a U.S. Customs program that refunds up to 99 percent of duties, taxes, and fees on imported goods that are later exported or destroyed. With proper documentation, claims can go back five years and deliver significant cost recovery.

• Foreign Trade Zones (FTZs) – secure areas near U.S. ports of entry that legally sit outside U.S. customs territory. Businesses can bring in materials for storage, assembly, or manufacturing and delay duty payments until goods enter U.S. commerce—or avoid them entirely if the goods are re-exported. FTZs also offer benefits like duty deferral, inverted tariffs, and streamlined customs entry.

• Bonded Warehousing – a flexible option to store goods duty-free until a business decides to import them or re-export them. This is especially valuable if tariffs might change, since duties are only paid when goods officially enter U.S. commerce.

These programs can free up cash flow, lower costs, and give hardwood companies more control over pricing and supply chain strategy during a volatile tariff climate.

Curtis Struyk’s View from the Ground

NHLA spoke with Curtis Struyk, President of TMX Shipping, for an on-the-ground view.

“The March 2024 log ban in China cut off half our log exports,” Struyk said. “If it stays in place, we risk losing that market as China finds other suppliers.

Despite the challenge, Struyk sees opportunity:

• Vietnam is filling the gap in demand, and its sawmills are expanding capacity.

• Shipping rates are at historic lows — $150 per container to Vietnam.

• Face-to-face matters — “Nothing replaces sitting down with a customer to build trust.”

Struyk summed it up best:

Curtis Struyk, President of TMX Shipping

“Trade is unstoppable — like water, it always carves a path forward.”

His point is that even with bans and tariffs, global demand finds a new channel. For NHLA members, this means staying flexible, watching for where demand is shifting, and positioning to meet customers wherever the opportunities arise.

Your Next Steps

1. Engage – Submit comments to Commerce on Section 232.

2. Diversify – Look beyond China to Vietnam, India, Pakistan, Southeast Asia, the Middle East, and Latin America.

3. Control Costs – Use FTZs, bonded warehouses, and duty drawback.

4. Stay Informed – Watch for the Supreme Court decision in November.

5. Connect – Use the NHLA and AHEC missions and events to exchange strategies.