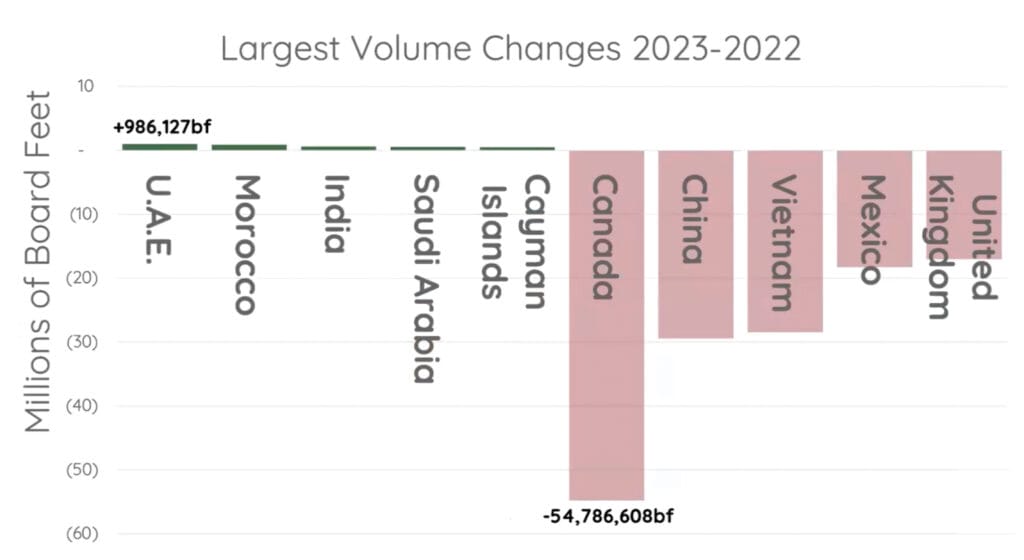

With U.S. lumber exports currently down millions of board feet in traditionally large markets like China and Canada, members of the American Hardwood Export Council (AHEC) remain encouraged by growth from smaller buyers like Vietnam, the Middle East, India and Europe.

Michael Snow, executive director of AHEC, recently noted at an end-of-year membership meeting that America’s wood industry wasn’t having “a banner year” through the third quarter of 2023.

“I think it is important to look at where we are,” he added. “Hopefully we will see a little claw back. The story is not an overly positive one.”

Tripp Pryor, the international program manager for AHEC, presented an “export stat update” for those in attendance.

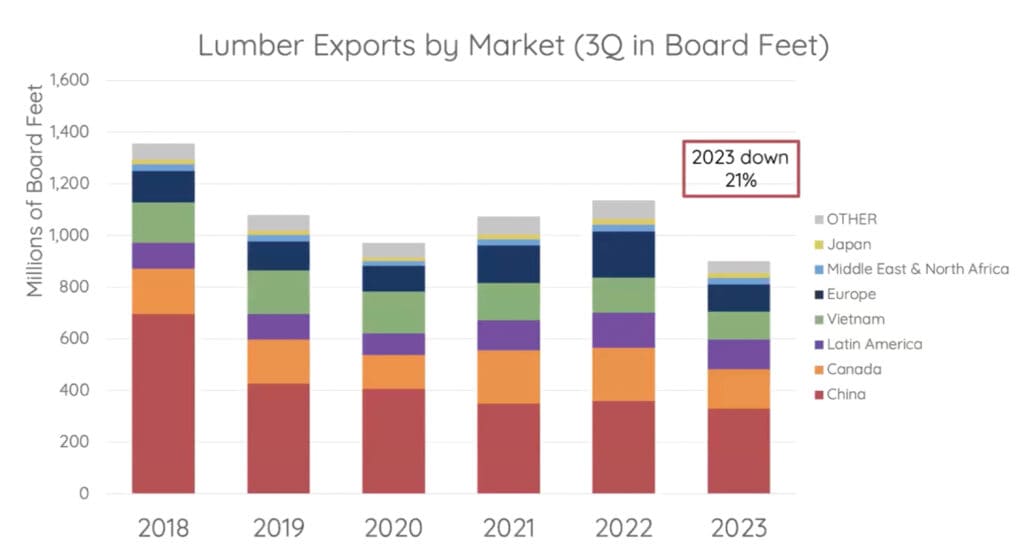

At the time of this writing, he acknowledged that lumber exports were at the lowest volume since 2011. He added that there was a drop of 896 million board feet, or 21 percent, from 2022.

“So,” he said, “it has been a fairly difficult year.”

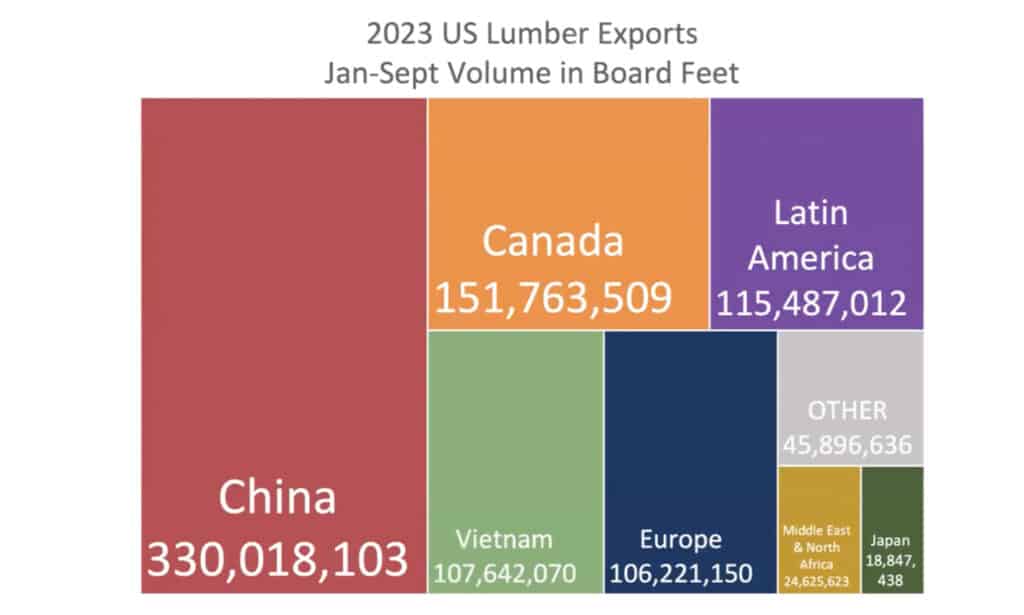

Despite the decreases, Pryor said that China “still dominates the export picture for lumber.”

The country purchased 330 million board feet through January to September of 2023 (the latest data available at press time), with Canada accounting for 152 million and Mexico at 115 million.

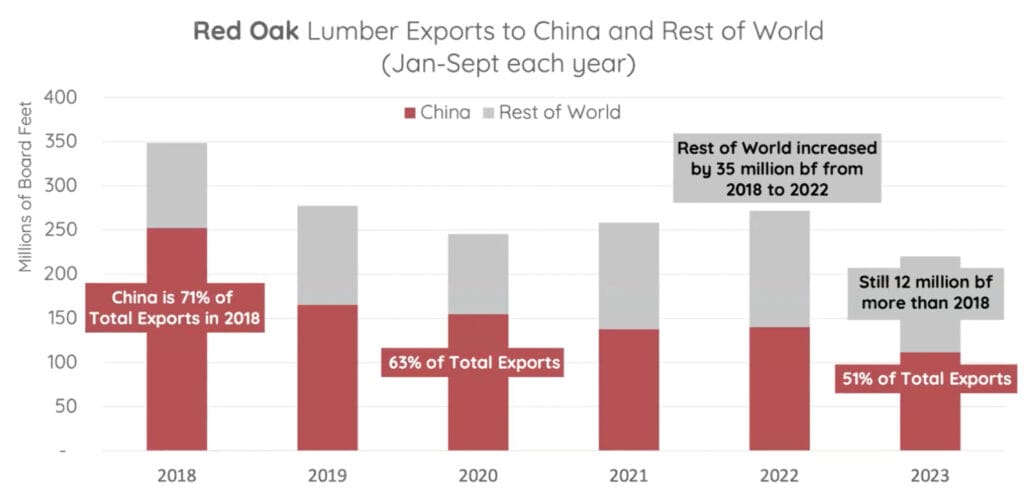

Pryor added that one of the major drops in the export market has been Red Oak. Cherry and Walnut have seen a modest uptick in foreign sales.

“China (accounted for) 71 percent of total exports for Red Oak in 2018,” he said. “It was close to 80 percent in 2016 and 2017. ”

The number sank to 63 percent in 2020 before landing at 51 percent in 2023.

“Exports of Red Oak lumber to the rest of the world increased by 35 million board feet from 2018 to 2022,” Pryor said. “But that is not enough to replace the demand lost in China.”

In total, China’s lumber imports from the U.S. were down 8 percent in total volume, which resulted in a 20 percent drop in value.

“That is what is hurting,” Pryor said. “There is a global softening for demand, lowering lumber prices.”

Pryor said he is optimistic of the growth potential seen in markets like the Middle East, India and Vietnam, which imported 107 million board feet of lumber through September of 2023.

“That is encouraging,” he said.

While log exports were also down in 2023, countries were buying a “wider diversity of logs” through 2023, according to Pryor.

In 2018, China began importing a broader spectrum of species from the U.S., with Yellow Poplar and Maple accounting for 12 percent of logs purchased.

“However in 2023,” Pryor said, “it has been largely concentrated with the main four species; Walnut (30 percent), Red Oak (29 percent), Ash (18 percent) and White Oak (14 percent).”

In 2018, the U.S. exported 1.8 million cubic meters of logs. That number had dipped below 1.4 million in 2023.

Through September 2023, the U.S. was primarily exporting logs to Greater China, Canada, Vietnam, Europe, and Japan.

The American Hardwood Export Council (AHEC) is the leading international trade association for the U.S. hardwood industry, representing the committed U.S. hardwood exporters and the major U.S. hardwood product trade associations. AHEC runs a worldwide program to promote the full range of American hardwoods in over 50 export markets.

For more information, go to www.ahec.org.

(Editor’s Note: data represented in graphics sourced from USDA GATS)