Inflation And Rising Housing Costs Show Signs Of Cooling

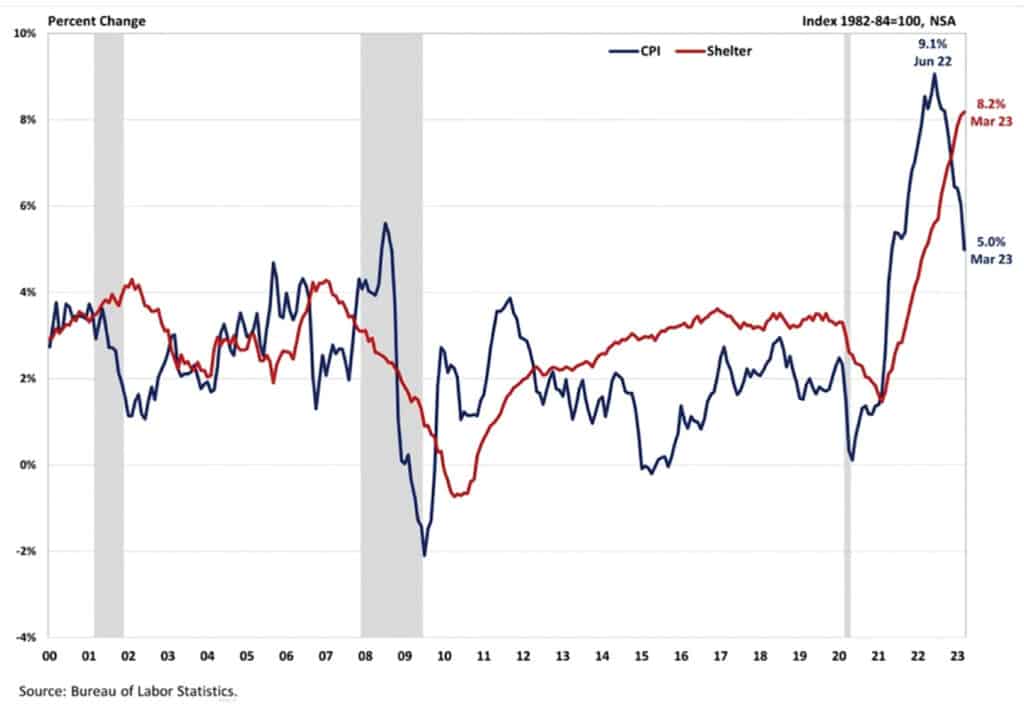

The National Association of Home Builders (NAHB) recently reported that the overall inflation rate, along with the cost of housing, showed signs of cooling in March, which is the latest data available, with the shelter index (housing inflation) experiencing its smallest monthly gain since November 2022. Still, housing in March continued to be the largest contributor to the overall inflation rate, accounting for more than 60 percent of the increase when excluding the volatile food and energy sector.

The data is also a clear sign that the Federal Reserve’s ability to address rising housing costs is limited, as shelter cost increases are driven by a lack of affordable supply and increasing development costs. Additional housing supply is the primary solution to tame housing inflation.

And further Fed tightening of monetary policy will hurt housing supply by increasing the cost of acquisition, development and construction (AD&C) financing. Nonetheless, the NAHB forecast expects to see shelter costs decline later in 2023.

The Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) rose by 0.1 percent in March on a seasonally adjusted basis, following an increase of 0.4 percent in February. The index for shelter, which makes up more than 40 percent of the “core” CPI (core defined as the change in prices of goods and services, except for those from the food and energy sectors), rose by 0.6 percent in March, following an increase of 0.8 percent in February.

The indexes for owners’ equivalent rent (OER) and rent of primary residence both increased by 0.5 percent over the month. Monthly increases in OER have averaged 0.6 percent over the last three months. These gains have been the largest contributors to headline inflation in recent months.

During the past 12 months, on a not seasonally adjusted basis, the CPI rose by 5 percent in March, following a 6 percent increase in February. This was the slowest annual gain since May 2021. The core CPI increased by 5.6 percent over the past year, following by a 5.5 percent increase in February. The food index rose by 8.5 percent, while the energy index fell by 6.4 percent over the past 12 months.

NAHB economist Fan-Yu Kuo provides more analysis in this Eye on Housing blog post which can be found at www.eyeonhousing.org.