Lumber exports from the U.S. in 2020 were impacted by a single global denominator – the coronavirus (COVID-19). That followed a multi-year trade war with China that dealt an additional damaging blow to U.S. lumber suppliers.

Still grappling with the pandemic’s effects, the world is moving forward with vaccination distribution, hopeful that in 2022 some normalcy returns to mundane life. The lumber industry has not escaped COVID’s grip nor has the U.S. market recovered from the ripple effect of the trade war with China.

Domestically, however, the lumber market has been met with meteoric demand from buyers. This has been driven by homeowners confined during the pandemic tackling DIY home projects, restaurants that scrambled to construct outdoor eating areas, and new home construction sales that are up over 19 percent last year based on year-over-year figures.

But what about globally? How has the North American Hardwood lumber market fared with such challenges?

Michael Snow, executive director of the American Hardwood Export Council, recently tackled these issues in a report. In brief, the U.S. has lost market share worldwide thanks to COVID. But the light is shining at the end of the proverbial tunnel, in part thanks to vaccine distribution to gain control over the pandemic, which is allowing pent-up demand to finally be released around the world and thanks to U.S. lumber exporters innovatively finding new overseas markets to sell into. Indeed, early 2021 seems to be dominated by strong global demand and right now the major impediment seems to be the ability of supply in the U.S. to meet that demand.

Let’s Begin with the Good News

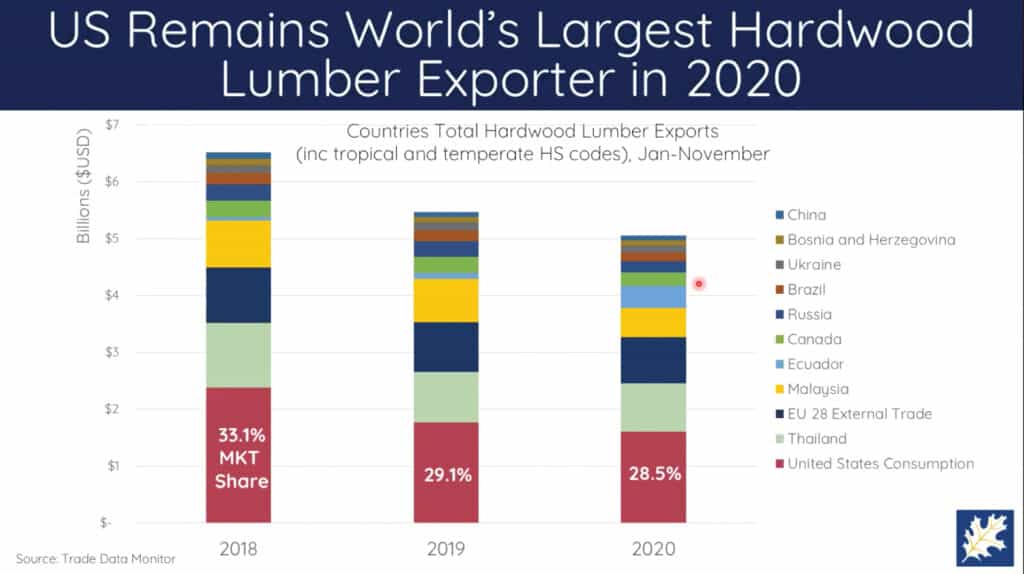

The United States is still the largest lumber exporter in the world, said Snow. “But we are not the largest lumber producer in the world anymore. However, we still lead in exports at 28 percent although we’ve seen a fairly steep decline starting back in 2018 – before COVID, which simply accelerated things from 2019 through 2020.”

How Did the Trade War with China Change the Market Pre-COVID?

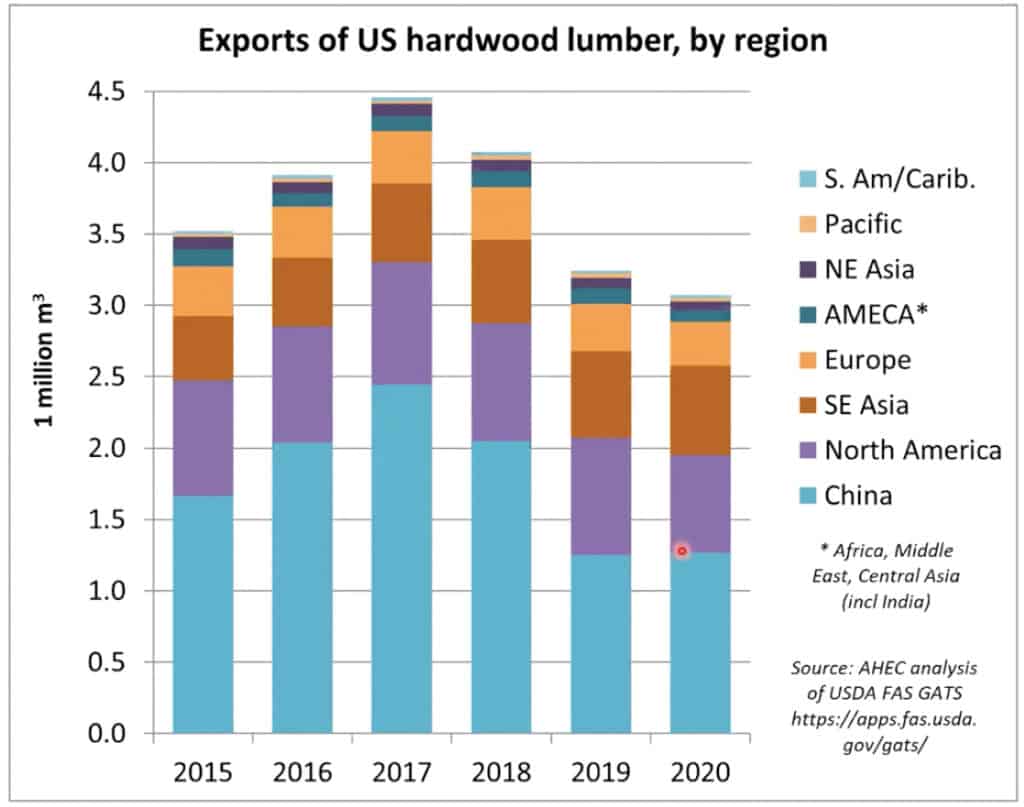

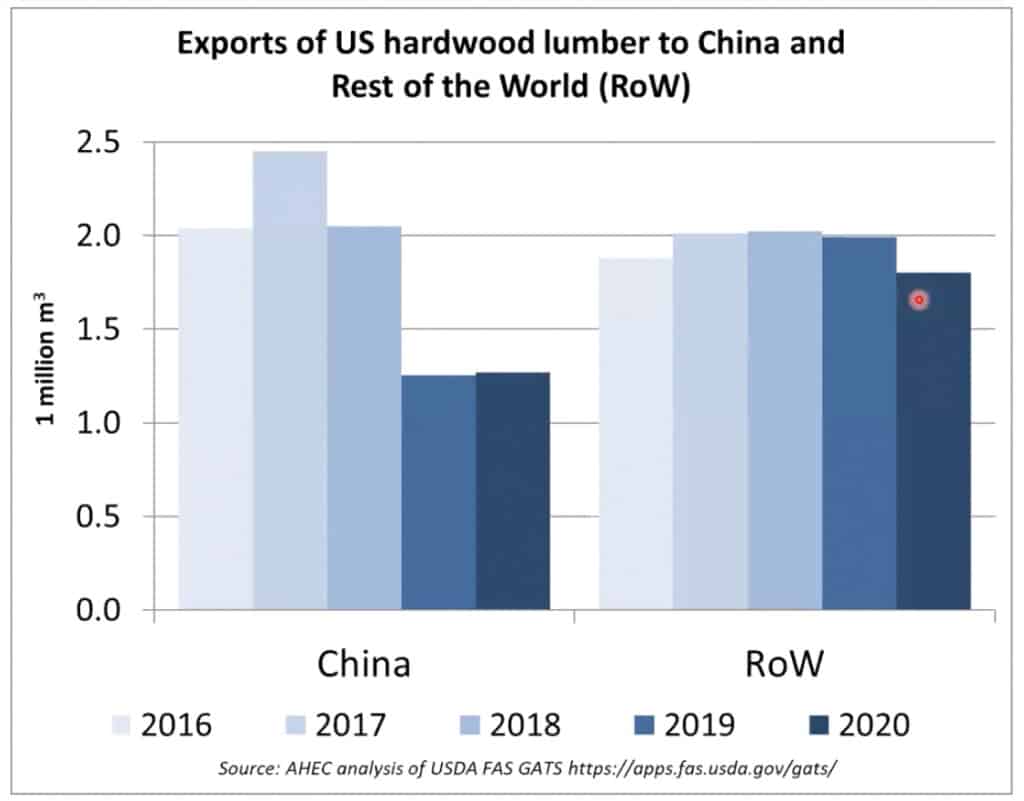

“Even in 2017 and 2018, we had more exports of Hardwood lumber going to China than to the rest of the world combined. With the trade war under the Trump Administration, that obviously changed. We are now selling significantly more to the rest of the world than we are selling to China,” Snow explained. “I would like to say that’s because we diversified, but the truth of the matter is because our China business declined so precipitously with that trade war, and also with COVID in 2020, it is hard to overstate the impact that the China market has had on our exports overall.

“What we are hearing now is that a lot of traders in China are pretty bullish and we are starting to hear that inventories are fairly low so I think it will be an interesting year – assuming the coronavirus can be brought under control globally.”

As a result of that trade war with China, Snow said, “We lost our position as being the number one supplier of sawn Hardwood lumber to China. Back in 2018, we were nearly one-third of all imported Hardwood lumber going into China and that declined to 21 percent in 2019 on a percentage basis. It increased a little in 2020, but that has more to do with reductions from other countries than any major increase from the U.S. We basically lost our position as China’s main trading partner for Hardwood lumber. I think that is concerning because we know once you begin to change supply chains for different companies, it is very difficult to change them back.”

Snow further explained, “The Phase 1 Trade Deal with China was an absolute bust. China never came anywhere close to meeting their commitments under the trade deal, which I think most economists from the beginning thought it was absurd to begin with because it was based essentially on managed trade. China said ‘we are going to buy X amount of these particular products’ rather than let the market decide what was in demand. Those goals were not possible. They were ambitious but not realistic.”

What Happens Next?

Under the Biden Administration, getting COVID under control and rolling out the vaccines to save lives took center stage. “Upon taking office, I don’t think the Biden Administration wanted to stir up the trade front, opting to get some other things under control first, such as COVID,” Snow said.

What happens on the trade policy front is also of importance to our industry, and as Snow noted, “One major event that occurred in late 2020 without anyone in the U.S. really talking about it, but from an economic and business perspective is going to be seismic, was the signing of the largest free trade agreement ever – The Regional Comprehensive Economic Partnership, or RCEP in the Asia-Pacific region.

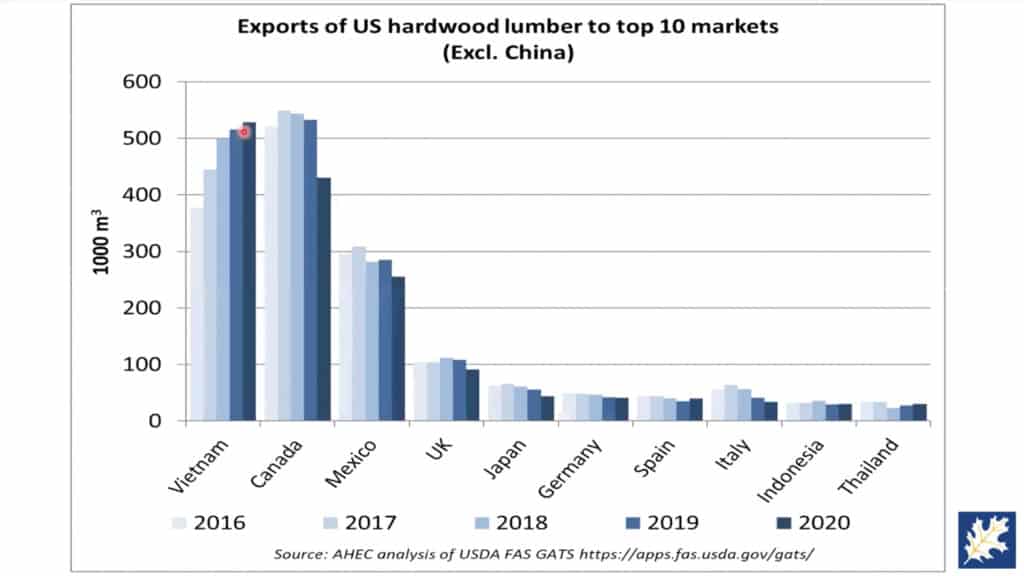

“When you look at who is involved in this, of course obviously China, our biggest market, Vietnam, our second biggest market, but then, consider also who is supplying China and Vietnam with Hardwood lumber and logs and it’s a lot of countries that are involved in that free trade agreement. So, again, we have the possibility that we are being left on the outside looking in as most of the rest of the world is moving on with free trade agreements that expand in trade. We have sort of been putting our head in the sand for the last several years. This trade agreement is bigger than NAFTA. It’s bigger than the EU, and it’s the largest trading bloc ever created. As I said before, we are going to be left on the outside and the rest of the world is moving on. It’s important to remember that free trade agreements do make a difference.”

Snow commented further: “Consider where our trade deficits were going back to 2018 – we started a trade war with China. We actually now have a higher goods and services trade deficit with the rest of the world than we did then. In fact, we ended 2020 with our highest bi-lateral trade deficit ever with China. So, we’ve gone through all this pain, all this money that we’ve paid to farmers to keep them happy with the tariffs, all of this market distortion and we not only have nothing to show for it but we have actually found out that we are worse off than we were. So I really hope that the Biden Administration takes a look at this and sooner rather than later tries to craft some kind of a trade policy that’s going to set the U.S. up to participate in the global economy – because the global economy is going to move on whether we choose to participate in it or not. With that being said, at the same time here we have the U.S. launching an investigation into Vietnam. The U.S. did find that Vietnam was manipulating its currency, but the outgoing Trump Administration did not recommend any type of punishment. They left that to the Biden Administration. If our trade war with China—our largest market for American Hardwoods—turns hot again and at the same time we begin a trade war with our second largest market in Vietnam it could have a devastating impact on our industry.”

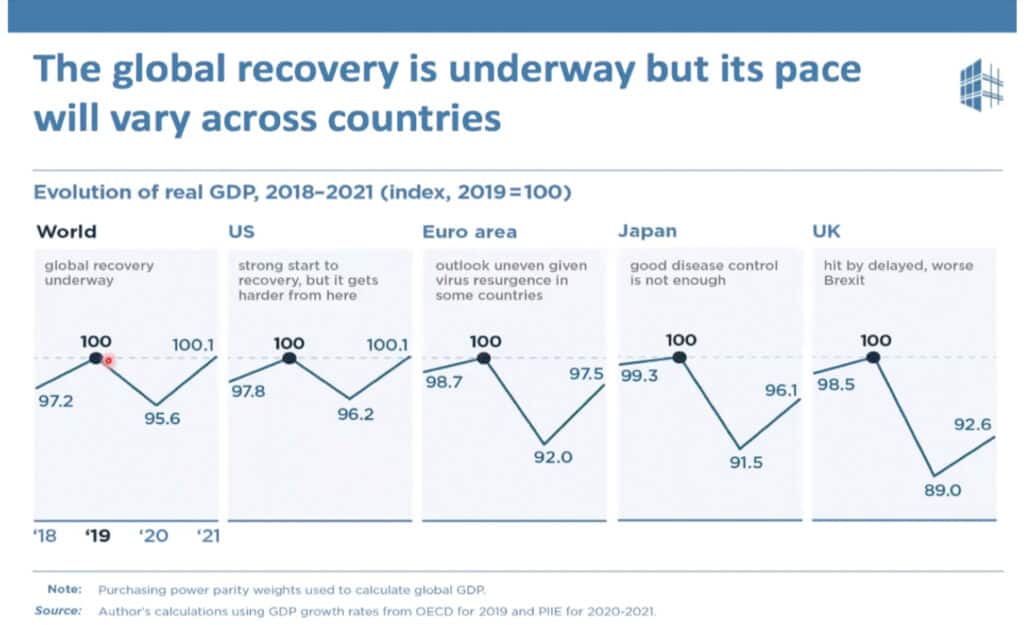

Is the GDP Rebounding? The Light at the End of the Tunnel

While 2020 saw the biggest decline ever in the global GDP, Snow stated, “The good news is some countries are already experiencing a bounce back, notably China. Again, assuming that the vaccines are distributed worldwide, we can get back to some normalcy. A lot of economists are expecting a fairly quick bounce back in 2021 into 2022.”

To learn more, visit www.ahec.org.