By Sue Putnam

(Editor’s note: For the purpose of the research discussed in this article and accompanying graphics, the term renovator refers to the consumer. The term prosumer refers to the professional person that a consumer hires to complete the work.)

The Real American Hardwood Promotion Coalition (RAHPC), which was formed in 2019 to identify opportunities and challenges in promoting the American Hardwood industry, is rolling out a marketing strategy in phases over the next few years that promises to go far in re-defining the value of Hardwood in consumers’ homes. That, in large part, is the hope of the executive committee of the RAHPC that recently presented plans after conducting extensive research to secure meaningful data.

Presenters during a recent RAHPC webinar acknowledged surprising findings from that research. For example, Millennials do not rank sustainability high as an influencer in the final decision.

Perhaps most importantly, the cost of real Hardwood, regardless the application in which it’s used, is a serious obstacle that consumers of all ages consider when buying materials to renovate their homes.

This has caused the Hardwood industry to lose market share in the last decade while cheaper substitute materials have gained.

So what can the Hardwood industry do to change consumers’ perceptions and increase market share?

• The following are the initial findings of the RAHPC:

Dana Lee Cole, of the Hardwood Federation, began the recent presentation by explaining that “the Coalition gathered insights through a variety of research methods and from numerous target audiences including architects, contractors, home renovators (consumers), designers, Millennials, and GenXers to assess perceptions of Hardwood attributes, as well as those of competitive products, and to understand which are most influential in driving consumer decisions.

• Hardwood Industry Challenges

RAHPC is committed to creating a new promotional campaign to mitigate the following challenges:

• The rise in competing products, particularly substitute products, which has resulted in shrinking domestic Hardwood markets.

• Disinformation spread by activists which has negatively impacted consumer perception of the quality, value, and sustainability of Hardwood products.

• The negative financial impact of the ongoing trade disputes with China that continues to disrupt grade lumber and industrial markets.

• RAHPC’s Goals

These are designed to provide long-term vision, focus and continuous motivation, Cole said.

• Increase members’ domestic markets by raising awareness of the benefits of Real American Hardwood.

• Enhance consumer and prosumers perception of Hardwood’s value.

• Generate new products.

• Improve industry profitability and stability

Troy Schroeder, whose company Clutch Performance has been hired to develop a brand and marketing materials, explained the research findings. The fact-gathering began in the first quarter of 2020 with focus groups in Chicago and Nashville and included participants previously mentioned. A nationwide survey was fielded and in addition, online bulletin boards of Millennials and architects were polled regarding their buying and designing decisions.

• The Good News….

The research subjects gave Hardwood high marks, finding it an attractive product that provides warmth and the right “look” to homes. They understood that Hardwood products are durable and lifetime lasting and healthy for their home. These findings, noted Schroeder, arms RAHPC with information that grants the opportunity to engage consumers early in the decision-making process and steer them to Hardwood instead of other products

• The Not-So-Good News….

Research finds that regardless of the quality of the material, such as wood, cost becomes more important as many respondents reported that “Hardwood durability doesn’t translate into ‘good value’ for the money.” Schroeder explained, “To persuade purchasers that Hardwoods are the best value, we must overcome commonly held beliefs such as laminate wood flooring is more durable, lasting, less porous, and requires less maintenance than Hardwood. Another finding from the research is the common misperception that faux wood is close enough and therefore a better value than real American Hardwood products.”

Furthermore, he said, these consumers want the look of Hardwood, but they accept the alternatives. In the consumers’ minds, the favor given to durability and beauty is lost because of misperceptions of cost of the product and value it brings to their home.

• Reaching Consumers, from Millennials to Boomers

Schroeder noted, “It is surprising to hear that an important audience like Millennials ranked ‘environmentally friendly materials’ low in their decision-making process. We must listen to the research and respect their focus on practical considerations like cost and overall budget restrictions. By engaging this key audience with details on the authentic beauty of real American Hardwood, and the lasting value it brings to their homes, our materials will promote the qualities that matter to them,” as well as other age groups.

• Focus on “Healthy Home”

While Millennials revealed that “being green” was less important than RAHPC expected, prosumers revealed that a top concern among their clients is for their family to have healthy products in their home. Schroeder stated, “This is an interesting bridge from sustainability-related product attributes to consumer-relevant concern. Consumers want to trust the products they put in their home and research revealed that consumers/prosumers also trust wood over products like vinyl.

“The concept of ‘Healthy Home’ differentiates Hardwood from competitors as only Hardwood possesses the natural product attributes that help satisfy the need for a safe, healthy home.”

This topic forms a strong foundation for RAHPC’s messaging for this industry, explained Dave Miller, also of Clutch. “Our data shows that we have the potential to develop an unbeatable messaging strategy that can create an emotional connection with consumers. This will require partnerships with retailers, execution of social media campaigns and other communication to consumers and prosumers.”

• Consumers Trust Big Box Stores….Hardwoods Need to Be There

Big Box stores, like Home Depot and Lowes, are the preferred reference points for today’s consumers (see accompanying graphic). Regardless of a consumer/ renovator’s age, Big Box stores attract them in droves. That’s because consumers can tangibly touch and see the product in question.

Tom Inman, of the Appalachian Hardwood Manufacturers Inc. addressed the need for the Hardwood industry to magnify its presence in these stores. “In the summer of 2020 we visited stores to see where we stacked up in our real American Hardwood product versus other competing products – be it tile, vinyl, carpeting – and space that is devoted to our product in these stores, as well as the messaging that’s visible, and we are under-represented in the flooring category, a little better in the cabinet categories, and the board programs. “There’s a lot of Red Oak and Poplar and other products – hobbies material – but we just have boards and moulding and millwork available there, we don’t have a very strong messaging that relates to our products. Why should consumers/renovators be purchasing those things over either plastic materials or some of these other substitutes that are out there? That’s an area that we must address, and we are developing plans towards that.”

• Previous Efforts to Promote Hardwoods

Miller commented that the 2011 Unified Hardwood Promotion and the 2017 National Wood Flooring Association Hardwood Marketing Research surveyed thousands of consumers and prosumers. He said, “They told us Hardwood is durable, attractive, lasting, and adds value and beauty to their home.

“Did we listen? We chose instead to focus on other messaging that we liked better, like sustainability and carbon neutrality.

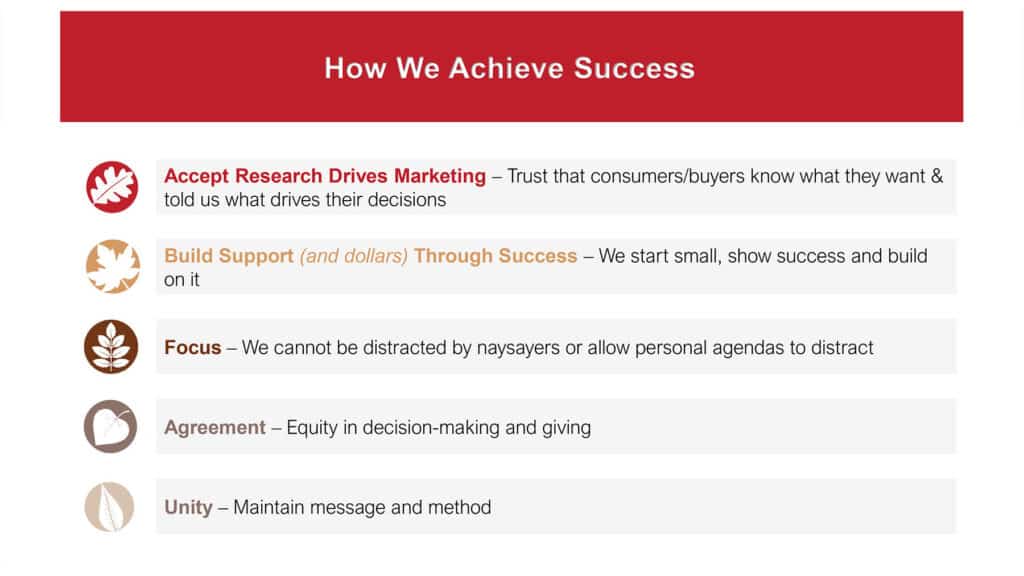

“The research done in 2020 confirms some previous results, and as long as we listen, the path forward is exciting and will be successful in the long term.”

• Looking to the Future

In September, RAHPC began distributing the Coalition’s playbook and defined logo branding. The marketing strategy will include consumer-facing materials based on what the Coalition now knows is important to consumers and prosumers. The Coalition announced it will launch the brand and implement a tactical marketing plan which will include: Paid Media, Social Media, Influencers, Media Relations and Partnerships by year end.

This plan includes a core set of activities that create an imperative foundation and then expands to additional recommended tactics based on participation, momentum and time in the marketplace. At the core of the plan is a content marketing approach that leverages original hosted content, targeted social media and paid search, as well as influencers to meet consumers at their point of inspiration – when they’re first considering their project and their vision of the end result. This ensures Hardwood is part of the consideration early on.

Lastly, the RAHPC plans to build on this early engage ment by surrounding consumers as they move toward consideration of actual products through media relations that tells the full story of Hardwoods – beauty, durability, lifetime value and healthy home. Additionally, RAHPC will develop retail partnerships that both reinforce the beauty of Hardwood with consumers and provide an opportunity to demonstrate benefits, as well as create opportunities to cross-sell consumers throughout the store. “The call to action is for all producers, distributors and secondary manufacturers of Real American Hardwoods to join us in domestic promotion,” said Inman. “We all must work together to educate consumers, designers, renovators and architects early in their research and decision-making processes.”

The RAHPC Team will recommend to contributing associations and their members very specific ways to use the branding materials in both B2B and B2C relationships. Companies that do not belong to a participating association will have access by sending an email to

hardwoodpromotion@gmail.com.

Want to learn more? Email your questions to hardwoodpromotion@gmail.com.