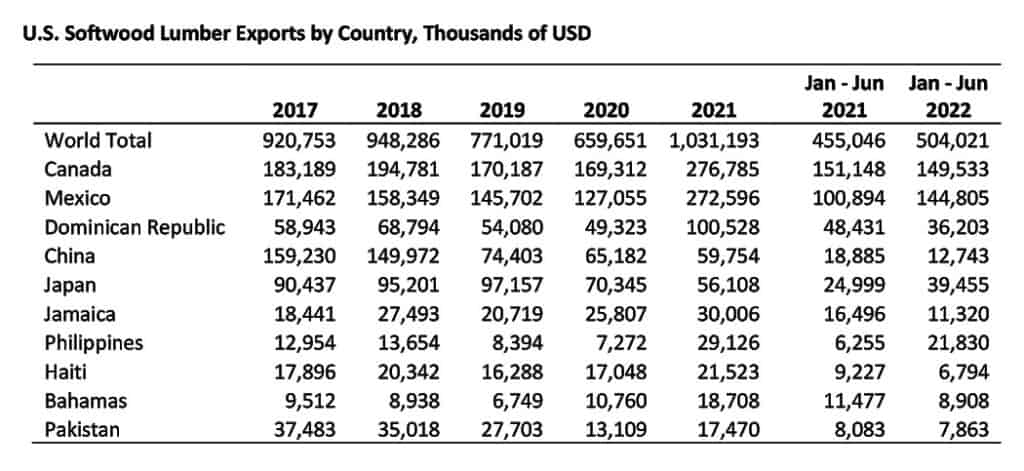

Those of us whose livelihoods depend on international markets have experienced a couple of challenging years as most U.S. suppliers focused on supplying the domestic market and record high U.S. Softwood lumber prices placed U.S. Softwood lumber out of reach for many international buyers. However, as prices continue to soften in response to lower domestic demand, exports of U.S. Softwood lumber have rebounded. From 2020 to 2021, U.S. Softwood lumber export volume increased 31% and export revenue increased 56%. Total 2021 Softwood lumber exports exceeded $1 billion. While lower prices have clearly been the central reason to this rebound, the U.S. is poised to continue to increase its global market share over the long term for a variety of reasons. Many of these reasons come down to a rising global shortage of legally harvested and sustainably managed timber – factors where the U.S. excels.

For years mills have debated what to do with the excess supply of lumber in the U.S. South, where timber growth is twice the rate of removals. As companies established mills in the south to take advantage of the ample supply, they knew they needed to develop new international markets to consume the production. COVID-19 and the related housing and repair and remodeling boom provided a solution, albeit temporary. Contrary to the gloom-and-doom predictions, the market surged beyond anyone’s wildest predictions. However, rising interest rates and inflation have pushed affordability out of reach for many homebuyers and remodelers and U.S. suppliers now find themselves both competitive in and finding international markets necessary.

International buyers who have discovered the benefits of U.S. species are pleased that U.S. product is more readily available and affordable. For example, exports to Mexico, where manufacturers prefer U.S. heat treated species and American suppliers enjoy more favorable rail prices compared to ocean freight rates from South America, U.S. exports increased from $127 million to $272 million over the past year. January-June 2021 vs 2022 export revenue is up 43% despite lower 2022 prices, and export volume is up 154%. Buyers in Pakistan, which was a non-existent market for U.S. Softwoods prior to 2017, is now the leading international market for Eastern White Pine, thanks to market development efforts by SEC. During COVID, buyers in the country were largely unable to source supply due to competition from buyers in the U.S., but with travel restrictions lifted, SEC hosted a group of eight buyers from Pakistan on an inbound mission in June where they met with suppliers.

As standing timber in much of the U.S. continues to increase, the supply of legally harvested international timber is declining. A November 2022 ban on timber sales of old growth forests in B.C. restricted harvests on 1.4 million acres (2.6 million hectares) and analysts project that this could result in the closure of 14-20 mills. Old growth logging, which constitutes one-quarter of B.C.’s annual timber harvest is declining as availability of these forests is declining and becoming more inaccessible. Prior to the Ukraine invasion, Russia exported 28 million cubic meters of lumber annually, much of which is now subject to international conflict timber bans. While half of Russia’s lumber exports are sold to China, China’s flagging real estate market is likely to hamper those sales.

The U.S. also benefits from the global drive toward legally harvested and sustainably managed timber. Global furniture retailers are increasingly demanding chain of custody certification to ensure that the products they carry are produced from legally harvested timber – a move that is negatively affecting tropical timber in favor of SFI certified U.S. timber. Finally, South American producers such as Brazil are facing massive annual losses which is pushing log costs to a point where they are now higher than in the U.S. Brazil’s National Institute for Space Research estimated that between August 2020 and July 2021 3.3 million acres of forestland was lost – a 22% increase from the previous year. It marks the greatest area lost to deforestation in the Brazilian Amazon since 2006 when a total area of 3.5 million acres was cleared. These issues place the U.S. in a key position to improve its competitiveness in international markets.

The last two years have been both a challenging time for U.S. producers and a boon. While logistics will likely remain with us for a while, recent changes in the domestic economy underscore the importance of remaining diversified in our domestic and international markets. Thanks to sound forest management laws and practices, while timber supply in other areas of the world is declining, the U.S. has a long-term supply of timber – and our sustainable forest management practices only bolster our marketability. The trade groups that promote U.S. Softwoods internationally remained committed to promoting U.S, Softwood lumber throughout the COVID travel bans and domestic market boom, and we are now seeing customers return to international trade shows in greater numbers than prior to COVID. These customers visit our booths looking for certified products, suppliers who can provide a long-term supply, and alternatives to Russian Larch. Others specifically seek out the U.S. booth looking for specific U.S. species such as Eastern White Pine.

With COVID in the background, export is ready to flourish. It’s a lot of work, but with so many factors working in our favor, it surely will be worth it. At a minimum, tapping into this ocean of outside demand will allow U.S. lumber companies to diversify their risk – and rewards, between domestic and international business while finding new markets for our ample domestic timber supply.