Hardwood Market Report Editor David Caldwell recently presented the Hardwood Market Update during a complimentary webinar hosted by the Hardwood Manufacturers Association. To follow are excerpts of Caldwell’s presentation.

How 2020 Began…

2020 started out with such great promise. On January 15th, China rolled back tariffs on U.S. produced Hardwood lumber. Hardwood lumber sales to China increased in January to the highest monthly level since May of 2019.

Domestic business was clipping along at a nice pace too, led by the longest housing boom since the U.S. Census began tracking housing data.

And, industrial markets were performing well.

In January, Eastern U.S. sawmill production recorded the highest level of output since October of 2019 and remains the monthly highest rate this year.

COVID-19 changed all of that. As we know, the virus started in China, and that country’s economy was hit first and hit hard.

In February and March of 2020, exports to China fell to the lowest pace since December of 2011. In fact, all countries have experienced a downturn in economic activity from the pandemic.

The result of 2020’s turbulence has been dramatic. GDP hit an all-time low in the second quarter of 2020 at -31.4%.

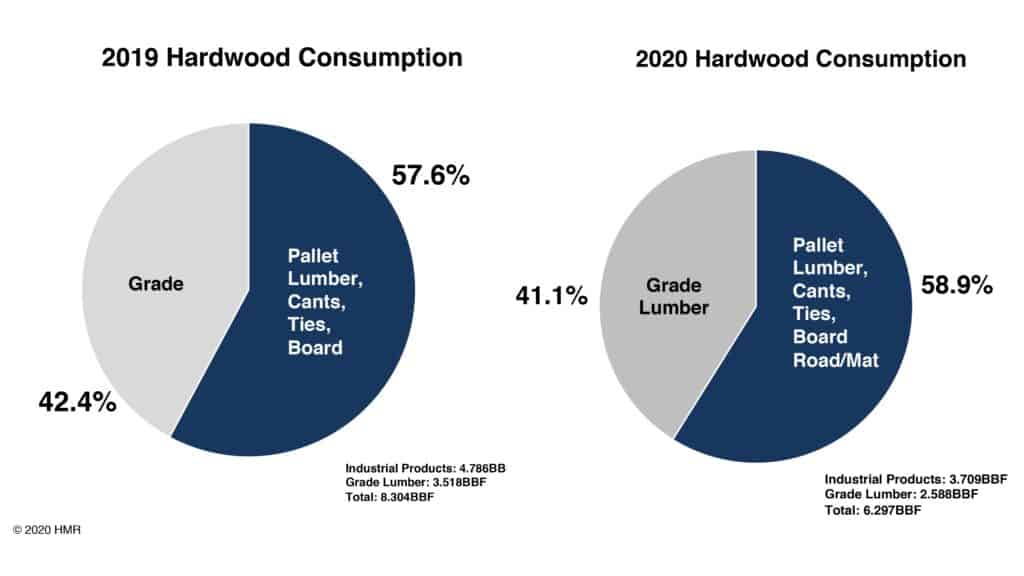

The Hardwood industry has not been spared. Through the first half of the year, industrial markets fell 1.1BBF; exports were off 159MMBF, and domestic grade lumber usage tumbled 723MMBF. Total consumption is down almost 2.0BBF in 2020 from 2019.

The main takeaway here is that industrial product consumption grew as a percentage of the total in 2020: 57.6% in 2019 to 58.9% in 2020, which means grade lumber consumption declined as a percentage of total consumption from 42.4% in 2019 to 41.1% in 2020.

Production follows demand. In the first quarter of 2020, sawmill output held up well, but as demand for lumber fell, so did production, to the tune of 35%. We are on pace to produce 1.8BBF less Hardwood material in 2020 than the previous year. That is 2020 in a nutshell.

But, even more concerning is the Hardwood industry is experiencing a longer-term trend in contracting demand and production.

Long -Term Adjustments to the U.S. Furniture Industry

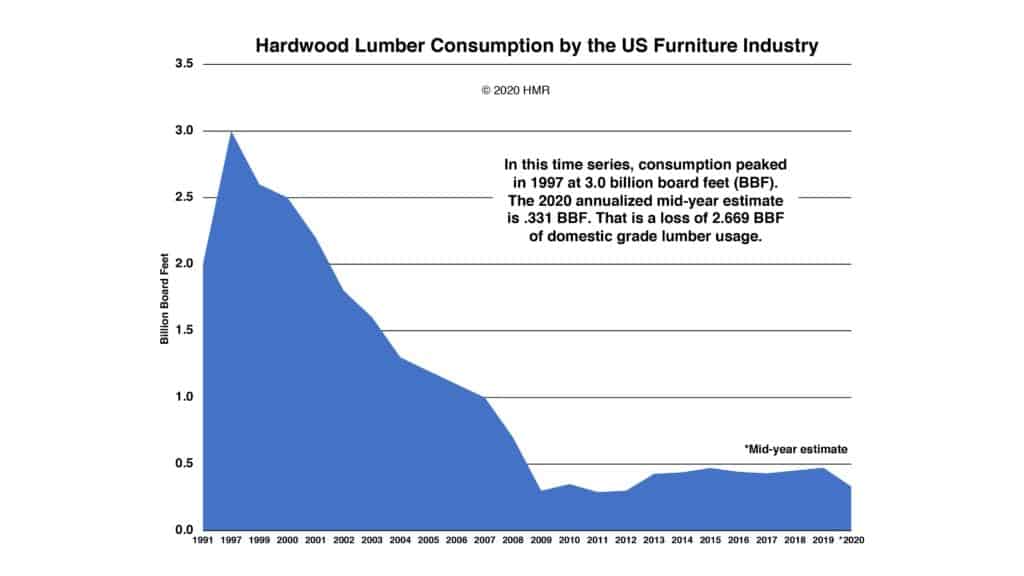

The U.S. furniture industry is the most notable example of the longer-term contraction of grade Hardwood lumber usage. It is estimated that 70% of furniture manufacturing has moved out of the U.S.

In 1999, the U.S. furniture industry used 3.0BBF of Hardwood lumber. In 2020, consumption was 331MMBF. That is a loss of almost 2.7BBF of grade lumber consumption.

Lumber prices have been affected from offshoring furniture manufacturing. Green 4/4 No. 1 Common Red Oak prices were fairly steady between 1992 and 2001, following U.S. housing market trends. As demand from the U.S. furniture industry decreased, lumber manufacturers were more reliant on foreign business or non-traditional markets, such as the solid wood flooring industry as outlets for 4/4 No. 1 Common Red Oak. The rapid rate of price change makes it difficult for primary and secondary manufacturers, as well as yards to plan for the future.

Moulding, Millwork, Cabinetry Trends

From 1997 through 2003, the moulding/millwork industry consumed 1.3BBF of Hardwood lumber. During the current trend to painted mouldings and millwork, non-wood products, softwoods, and imported species have taken market share from U.S. Hardwoods. Through the first half of 2020, Hardwood lumber consumption by the moulding and millwork industry was 386MMBF, much of which was Poplar. That is a loss of almost 1BBF of domestic Hardwood consumption from the peak. It seems to me that if we were promoting Hardwood show woods, we could increase higher value Hardwood species usage significantly.

Consumption by the cabinet industry peaked in 2005 at 1.6BBF. Granted that was at the height of the U.S. housing market. The 2020 annual estimate is 270MMBF. The sharp drop in Hardwood lumber usage by the cabinet industry in 2020 is heavily tied to COVID-19 shutdowns.

But, the longer-term trend has more to do with style shift and cabinet imports.

Over the past few years, there has been a shift to painted cabinets – light colored cabinets, light walls, and dark floors. This consumer preference shift is problematic for the Hardwood industry. You can put almost anything under paint. There is more plywood, MDF, and HDF being used in cabinet manufacturing. And, the painted cabinet trend has opened the door for more imported species and imported cabinets.

In the late 1990s, cabinet imports were low, with Oak cabinets favored over other species. Even during the U.S. housing boom in the early 2000s, imports were not extremely high. But, as show woods became less popular and painted cabinets more popular, cabinet imports spiked from 2014 through 2019. In 2018, imports were over 1.8 billion dollars. But wood kitchen cabinet imports declined in 2020. Data through July shows total imports were off 21.9% from 2019 to just shy of 1.1 billion dollars.

Obviously weaker demand the first half of the year was part of the reason for the decrease in imported cabinets in 2020, but the U.S. Dept. of Commerce imposed duties on Chinese cabinets, which stalled imports from China.

In 2018, China accounted for over 70% of cabinet imports. Through July of 2020, China shipped only 4.7% of cabinet imports.

Opportunity?

Is this an opportunity for U.S. manufacturers to regain lost market share from imported cabinets? I think so. But, the window of opportunity is narrow. Other countries, such as Vietnam, Malaysia, Indonesia, and Mexico are producing more cabinets to fill the void left by the decline in Chinese cabinet imports.

And, those countries are not necessarily using U.S. produced Hardwood lumber.

What about Solid Hardwood Flooring?

HMR’s flooring consumption numbers include residential solid wood flooring, truck trailer flooring, and sports flooring. The truck trailer flooring industry uses about 22.4% of Hardwood lumber consumed by all flooring manufacturers. This industry experienced a sharp downturn in business the second half of 2019 compared to the first half and is beginning to see some improvement in business. In fact, this industry is looking for a decent upturn in 2021.

The sports flooring industry is the smallest segment at about 3.2% of total Hardwood lumber consumption, and business for sports flooring manufacturers has held up better than the other two sectors. This sector is wrapping up projects that were planned a year or longer ago. New orders are slower.

The residential solid wood flooring sector is the largest consuming flooring market at about 74.4%.

Flooring shipments followed a similar trajectory to housing until after the housing bust. From 2012 until now, housing starts rose 73.8%, while solid wood flooring shipments fell 4.4%.

Why aren’t Flooring Shipments Keeping Pace with Housing?

A number of competing flooring products are designed to look like wood, and manufacturers have become really good at imitating the wood look. Even worse, their promotional campaigns tell consumers non-wood products are better and more environmentally friendly than the real thing.

These products are taking market share from solid wood flooring.

To a lesser extent, so have solid flooring imports. But, solid wood flooring imports declined during the pandemic to the tune of almost 45% in 2020 from 2019.

Imports comprised just 6.1% of total U.S. solid wood flooring consumption in 2020 compared to 35.7% in 2005. Most troubling is that even with imports down, U.S. shipments to U.S. markets have declined over 185MMSF since 2005. That equals about 300MMBF of lost lumber consumption.

The good news is flooring shipments are improving. After extremely low shipments in April and May 2020, they rebounded, rising each month after May. September 2020s flooring numbers surpassed September 2019 by 7.2%.

Pallet, Railroad Ties and Board Road/Mat Timber Trends

The wooden pallet and container industry consumes, by far, more Hardwood material than any other sector. This industry consumed 69.4% of all industrial material and almost 41% of all Hardwood production in the first half of 2020.

From 1991 to 2019, Hardwood pallet cant and lumber consumption by the pallet industry declined 23.3% or 1.1BBF. I did not include 2020 numbers because those are expected to increase before the end of the year.

The Hardwood consumption numbers are not going down because fewer pallets are being made.

So why has Hardwood consumption declined over time? Pine and other softwoods have taken market share as well as plastic and other non-wood materials.

Estimates show the global market for pallets should increase to $88.69 billion by 2026, with a compounded annual growth rate of 5.1%.

Wood pallets are expected to account for the largest share of the global market, but plastic pallets are expected to grow the fastest.

The railway tie industry is the only Hardwood consuming market that has grown since 1991. Hardwood usage has increased over 31% since 1991. From 2012 through 2017 the railroad industry consumed over 1BBF of Hardwood material per year. There is a very easy explanation as to why we have seen this level of growth. The Railway Tie Association began the 2 cent per tie program in the early 1980s that provides funding for research and development, as well as promotional campaigns for wood railroad ties. These efforts have proven wood is the best option for ties.

Longer term, rail shipments are expected to increase even more. The U.S. Department of Transportation projects rail traffic to rise 24% over the next 30 years. With higher rail traffic comes more tie installations.

Even with green 4/4 No. 2A Red Oak prices increasing, there is certainly incentive for sawmill operators to saw railroad ties. Not even taking into account the yield and production advantages of cutting ties, prices for ties are substantially higher than for green 4/4 No. 2A Red Oak.

Railway Tie Association Data shows a 4.9% decrease in purchases this year from 2019. But purchases are expected to regain some of those losses in 2021, up 2.8% to over 18 million ties.

What about the Board Road/Crane Mat industry?

These are some of the demand drivers for board road and mat timbers

- Transmission Lines

- Pipelines

- Drilling

- Roads and Bridges

- General Construction

- Board road and mat timber consumption is down. Estimates for the first half of 2020 show usage is off 18.0% from 2019 to an annual rate of 346MMBF. With high inventories and weak demand, it is likely this industry will not see much improvement in 2021.

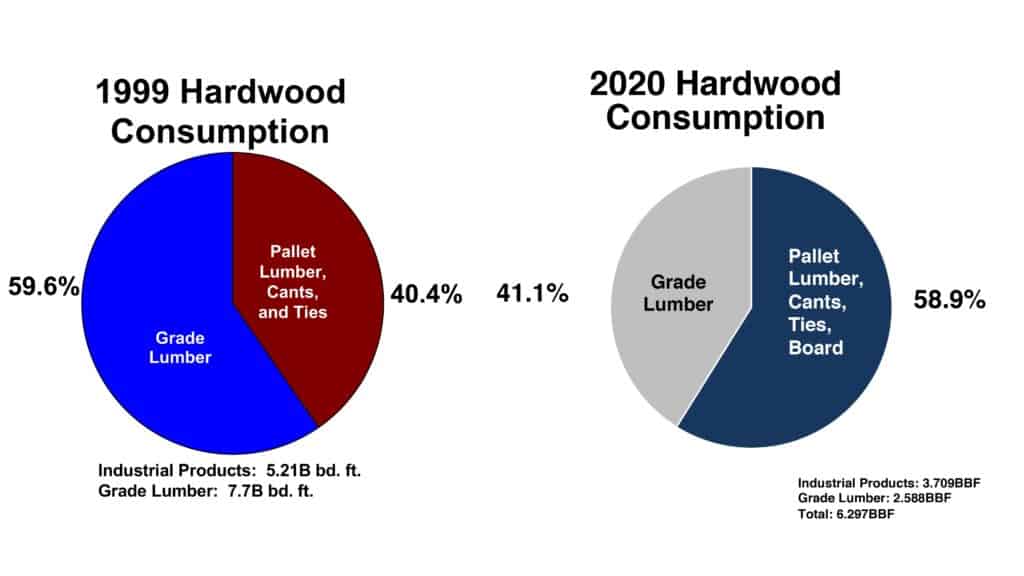

In summary, in 1999, grade lumber markets comprised almost 60% of total Hardwood consumption or 7.7BBF, and industrial products were about 40% of Hardwood usage or 5.2BBF.

Those percentages have almost reversed and grade lumber consumption was 2.6BBF in 2020, and industrial usage was 3.7BBF.

That is a loss of 5.1BBF of grade lumber consumption, and these numbers include exports.

Production follows demand.

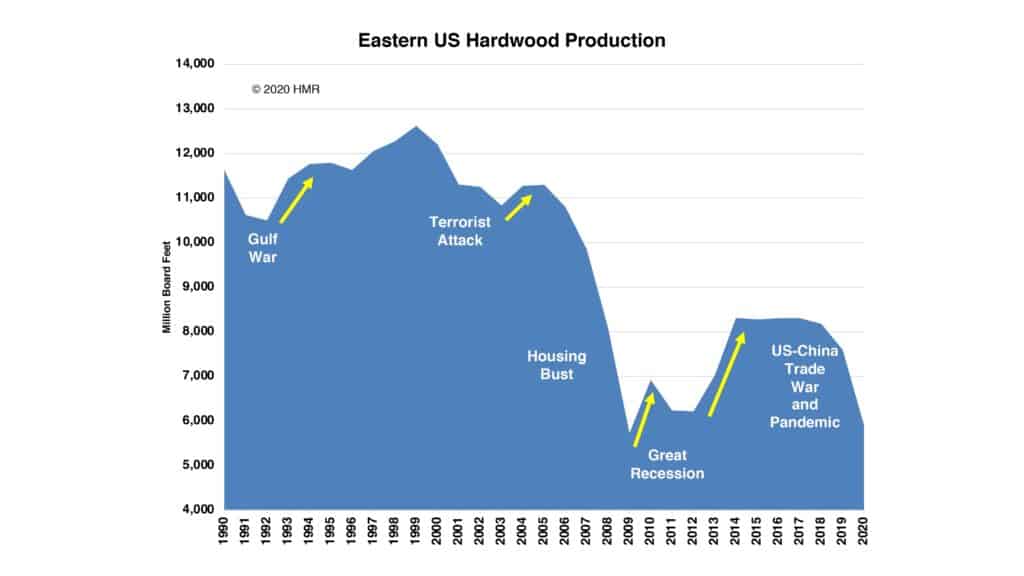

Currently, Eastern U.S. sawmill output is 3.56BBF below the 59-year average and 6.83BBF below the peak in 1999 to an annual rate of 5.79BBF, which is 1.1BBF short of projected consumption.

Each of the major events pictured in the accompanying graph caused sawmill output to fall, but as you can see, production recovered and as the yellow arrows illustrate, production recovered fairly quickly.

If history is an indicator of the future, production will rise to meet domestic and global market needs.