With 2021 now in the world’s rear-view mirror, the American Hardwood Export Council (AHEC), located in Sterling, VA, is setting its sights on emerging potential challenges and world forestry issues that may usher in changes for the North American hardwood community.

During a recent membership webinar, AHEC Executive Director Michael Snow elaborated on pending developments, many of which are still under deliberation by their governing bodies.

Snow explained, “There are going to be a lot of changes coming up on the environmental front, including the EU’s new deforestation-free, ‘low risk of forest degradation’ proposed law. There are some things in the draft document that could potentially be very damaging for us. At this time the proposal does not adequately define what the term ‘degradation’ means in practice across all of the world’s different forest types. Even more worrying is that the ‘degradation’ requirement only applies to timber and not other forest risk commodities, which makes little sense given the oversized impact that land use changes – particularly in regard to agricultural conversion of forestland – have on deforestation. As written, this would essentially ban all timber originating from large clear cuts or more in- tensive selective harvests that may ‘alter the species mix of future generations.’ Equally controversial is the proposal that the EU itself benchmark country risk assessments. Wood deriving from countries deemed ‘low risk’ would benefit from simplified due diligence requirements. With these, there would be no need for importers to conduct their own risk assessments or mitigation systems—only to collect documentation demonstrating the timber originated in a low-risk country. If the law is passed as is, then clearly the main focus for AHEC—and I would hope the USFS and U.S. government—would be to make absolutely sure the U.S. is benchmarked as low risk.”

Another factor complicating the EU’s risk analysis is that they are going to be combining a lot of different agriculture commodities under one assessment. Snow stated, “So, if there are issues with land-use change for products like cotton or soybeans it could essentially damage the hardwood industry in the same assessment region, and this would overrule the EUTR. So now, for the U.S., if things go through the way they are, the European Union is going to be the one that is going to risk assess each country. There are a couple different things that we are looking at to address this. We feel that the time is right to at least investigate what the potential is of creating a new certification system that is designed specifically for non-industrial, small land owners in our hardwood resource.

“The EU has opened the door for this with things like biofuels and biomass. So, they have shown that this can work. Now, they are going to have to defend why it only works for biofuels and not for long-use solid wood products coming from those same forests. There are a lot of unknowns as to what will be involved, but I think they are off to a good start and we at least want to figure out: is it doable or would it help our industry? Building the groundwork for this program, AHEC is moving forward with that with a series of state-by-state risk assessments in the U.S.”

Snow also spoke in some detail about the innovative World Forest ID program, which uses stable isotope analysis to demonstrate provenance of a sample of hardwood. He explained, “We have also been working with Dana Cole and the Hardwood Federation on the World Forest ID program. If you look at the EU regulation that came out, one of the more worrying aspects of it, if the law is passed as written, is even if something comes out of a low-risk country, even if the U.S. is considered low-risk, they are still going to require the operator to ‘collect the geo-location coordinates of all plots of land where the relevant commodities and products were produced.’ Geo Referencing is a large requirement to place on individual mills, but we feel long term that’s an issue that could be solved completely within the next couple of years if the USDA and Congress fund the World Forest ID project.”

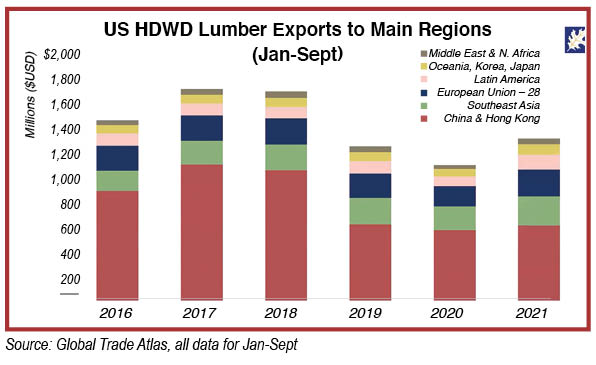

During the recent webinar, Snow also discussed the lumber export market, dubbing it “a pretty good come back from 2020. In fact, by export value we are actually above the pre-COVID year of 2019, although we still have a ways to go back to the pre-trade-war year of 2018. While other markets have improved considerably, exports to China are still significantly lower than they were before the trade war. So even with COVID shutdowns all over the world, the trade war and China’s economy slowing down is still looming large over the big picture of our exports now.”

Furthermore, he said, “There are a lot of things to be worried about in regard to China, but as things stand, it is still by far the largest market that we have, followed by Canada, Vietnam, Mexico, and the United Kingdom. The good thing is when you look at all the markets now, everyone except for Spain was positive in 2021.

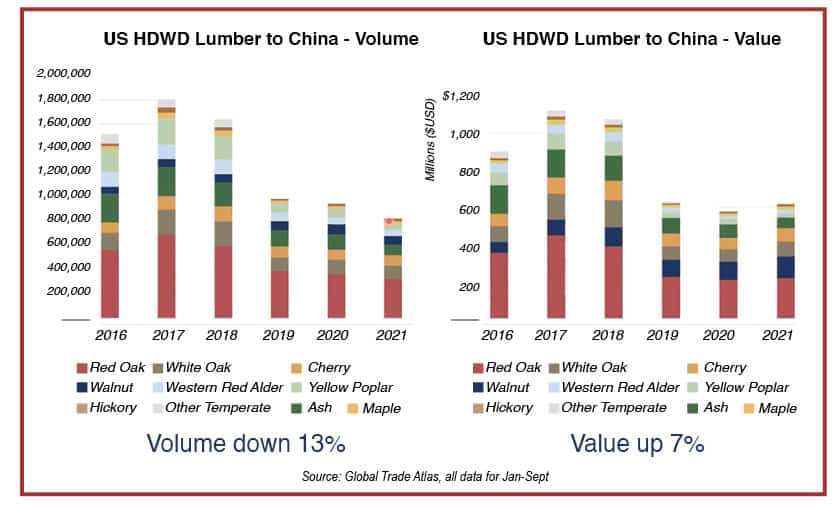

Snow added that a bigger slow down in the U.S. exports to China is anticipated over the next 12 to 24 months. He said, “We depended very, very heavily on China for our Red Oak exports and again, that’s a big part of why we need to keep those volumes of Red Oak going into other markets. After China and Canada, Mexico and Vietnam are the largest single purchasers of Red Oak. It is interesting that exports to Vietnam are up 20 percent in value, but down a little bit in volume, and I think a big part of that is because we are starting to see a switch. We are now starting to see Vietnam buying some of the Walnut that China slowed down on. We are seeing Vietnam starting to get into the White Oak markets a little bit heavier and at the same time decreasing species like Yellow Poplar. So I think a part of it is they are switching towards some higher end, and I think that might be a sign of the Vietnamese furniture industry moving up the value-added chain.

“So, the fact that even with all that market fluctuation, we are still seeing the increase bodes well and, hopefully, if the Omicron virus can be brought under control a little bit, I think Vietnam does remain a good market. Also, regarding Mexico, I think moving forward thanks to increased foreign direct investment in factories, we are looking at a huge jump in Mexico this year.”

Lastly, it is notable that the European Union has surpassed Vietnam as the third largest market for Red Oak after China and Canada.

The AHEC webinar also detailed upcoming overseas industry trade shows currently scheduled and highlighted various design shows involving North American hardwoods that AHEC helps develop, promote and/or sponsor.

Learn more at www.ahec.org.