By Sue Putnam

The tailwinds from the new home construction market in the U.S. will bode well for the domestic Softwood lumber market, however, challenges do loom on the horizon for the industry. With seasonal adjustments in tandem with COVID’s economic stressors, anticipate a 30 percent reduction in lumber consumption now and until the end of the year. These were but a few of the take-away points from a presentation by Paul Jannke, economist with the Forest Economic Advisors LLC. Jannke was a key speaker at the recent virtual conference hosted by the Northeastern Lumber Manufacturers Association.

Jannke summed up his presentation by noting: “The bottom line is that we are at a period where we think that markets are going to weaken from current levels if it’s only on a seasonal basis, but we do think that in the next couple of years the markets should be strong. We think there are a lot of tailwinds from growth, and demand and production is going to have trouble keeping up with that and then, pull in the offshore imports, which we are going to need. We will need to have high enough prices to get that wood to come in.”

Jannke led up to those statements by detailing various aspects of the economic situation impacting the Softwood lumber market. For example, he explained: “Lumber prices went up this year, not 50 percent, but 300 percent if you are talking about Western SPF 2×4’s, so that’s a similar ride for everything else. Obviously the question is: are we in a new era or are lumber markets set to remain really strong for a long time or are we going to see all seasonal patterns?”

He further explained that these prices are the highest lumber prices in 30 years, perhaps the highest prices on record after adjusting for inflation. He elaborated: “The largest increase historically was 200 percent back in 1992-1993 on timber framing and that was over a five-month period. So, this is a 300 percent increase over those same five months. Why do we see such a large run up in prices? First, these are inventory levels.

“We came into this year with pretty low inventories and then COVID-19 hit. This was something actually unprecedented since the Great Depression in terms of the speed with which we saw the decline. The response from the industry was to cut back on production. We saw big cuts in BC, Canada; they had a little bit lower cuts in Eastern Canada; a little bit lower than that in the U.S. West and no cuts in the South so much – just not increases over what we are looking at year-over-year. So, big drop in production and then – on the demand side – we didn’t see the demand come off.

“Why was that? We did see a big drop in housing starts but that was really short lived because it turned out that if we look at the people who actually lost their jobs, they weren’t necessarily in the higher income brackets. They were in the lower income brackets.

“Just using educational attainment as a proxy for income levels, the lower income brackets got hit much harder by the job loss than the higher income brackets.”

Jannke noted, though, that demand remains very strong for single-family homes. During COVID’s shutdown, he noted, people had no place to spend their time or their money. “Basically, they looked around and saw all the things wrong with their homes,” he said.

As a result of demand, he added, currently across all regions in the country, sawmills are making close to three times their costs. “What happens when your average sales price is three times your costs?,” he asked. “You keep producing lumber straight through any downturn that we see for a while because you are making a lot of money. So, from a production perspective, we think production is going to remain strong through the end of the year.”

Jannke said the industry is in a good place in the housing cycle, including renovation and remodeling (R&R). He stated: “Just as housing markets under-performed in the economy for the past 10 years, we can easily outperform the economy in the short term or even going forward because there are strong tailwinds for the housing industry in our markets.”

Are we in a V-shaped economy? Not exactly.

Jannke explained it’s more of a “K” shaped recovery. He added: “Some markets are going to go up and other markets are going to continue to go down. We could see some markets continuing to be weak while housing and R&R remain strong and that is actually our forecast. But having said that, the spike is typical improvement that we see in consumption. We are going to be subject to seasonal factors. What are those seasonal factors?

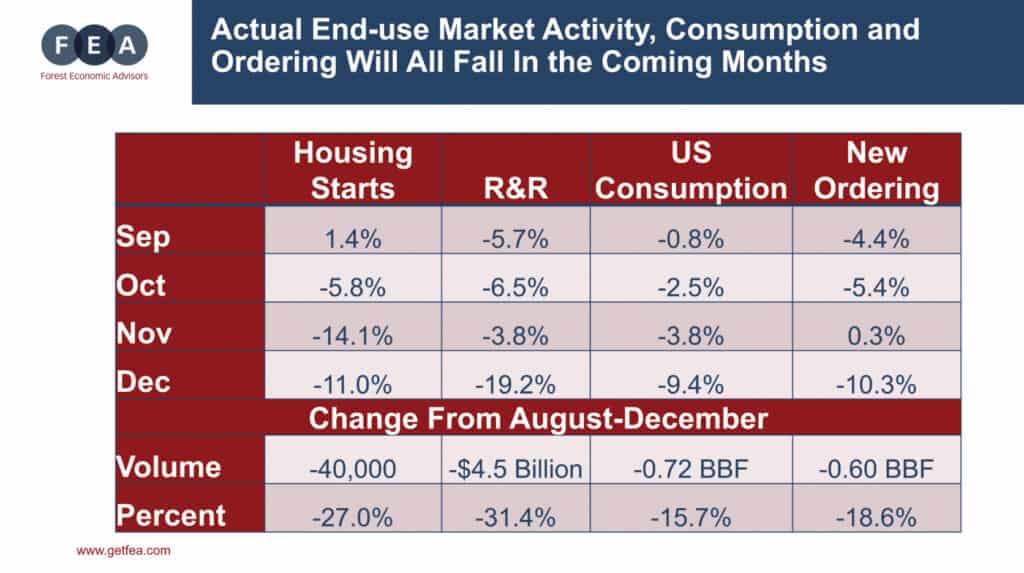

“On the seasonal basis we are going to see the actual numbers of homes starting to drop about 40,000 a unit, which is 30 percent. When it is the actual dollar spent on R&R, it dropped by about 5 billion, which is 30 percent. Why is that? Well, we are getting into the holiday months and there are fewer workdays because you have the holidays, there are also shorter days and seasonal weather.

“On a seasonal basis we are looking for about a 30 percent reduction between August and December and a lot less activity, and that translates into lower consumption.”

Jannke added that at the end of November, “we should see the duties coming off some lumber. If the preliminary determination to the first administrative review holds up we would expect to see the duties cut about half, which should help to lower the costs for the Canadian-produced wood coming into the North American market. We can fairly certainly say that there are stumpage costs in British Columbia from Q2 of 2020 to 2022 that are going to go up by about $60 to $85. So if you are looking in terms of their total costs, that’s a 12-18 percent increase in the total costs of producing lumber. That more than offsets the decline that you would see in the duty.”

What about longterm indicators for the Softwood market?

Jannke commented: “In the longer run we think markets are going to be really strong and we are looking for about a 7 percent increase in consumption in 2021 and then, about a 4 percent increase in 2022. Why the increase in 2021? Well, part of it is simply that things are improving. A portion of it is that in 2020 we are not going to see as much growth as we should have seen this year because of COVID. We did have a slowdown in consumption that occurred in March, April, May, and June, so that Q2 slowdown in consumption is going to hamper the total consumption numbers for 2020. That big jump in 2021 is in part because we don’t expect to see that sort of downturn that we saw in Q2.”

Why is that?

It’s all about disposable income, he said. “With the recession, (disposable income) came off pretty sharply but if you actually add back in the government transfer payments then, you see that actual real disposable income shot up pretty dramatically.”

He went on to state: “Early on in the next presidency we will see more stimulus if the economy is not out of the woods from the COVID recession.” Additionally, slowly unemployment is going down and retail sales are up, which is indicative of future output “because if people are consuming goods, you have to produce them,” Jannke noted.

What about mortgage rates?

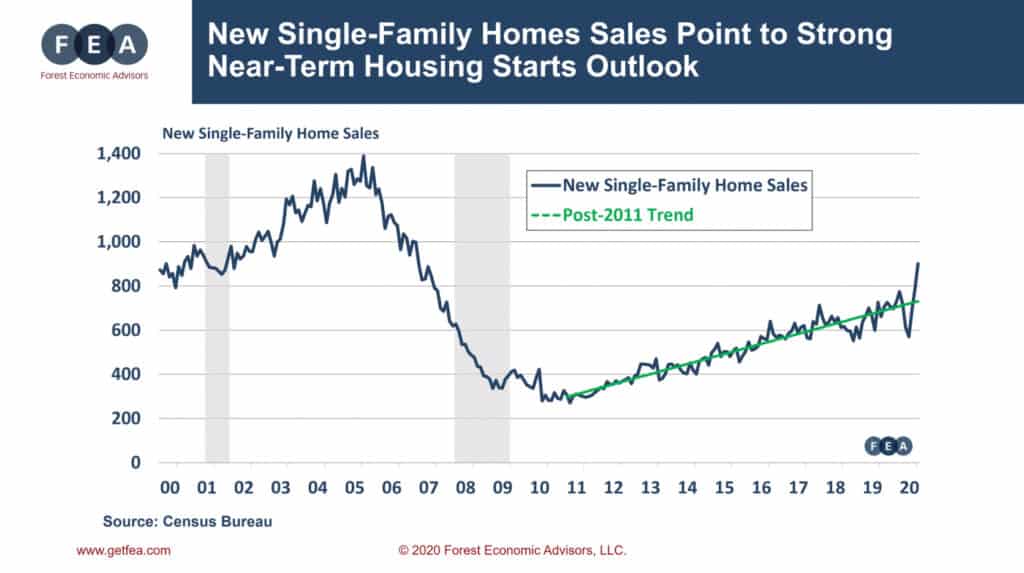

“One of the main drivers of our markets is mortgage rates,” he commented. “Rates are so low. The Chairman of the Federal Reserve basically said he can see keeping interest rates extremely low for three years-plus. So I don’t think we’re going to see any inflationary pressures pushing those mortgage rates up, and the result of that is obviously that (new) housing starts are back towards their pre-pandemic levels.”

Jannke said another tailwind from housing is the age class distribution in our society.

“Why are we going to be different coming out of this recession than we were coming out of the Great Recession? The reason is the age class dynamics of our population. That key 30 to 35 age bracket is now actually the largest age bracket as opposed to being one of the smaller ones. When we were coming out of the 2008 recession, we did not have those demographic headwinds. People in those populations were actually shrinking in 2008 whereas now, they are growing. So you have two places to fill those housing demands – either buying an existing unit or you can build a new one – and existing home units are at rock bottom inventory.

“This very strong rise in home prices is because the demand is outstripping the supply. Builders are making a lot of money and that is why they are so confident.”

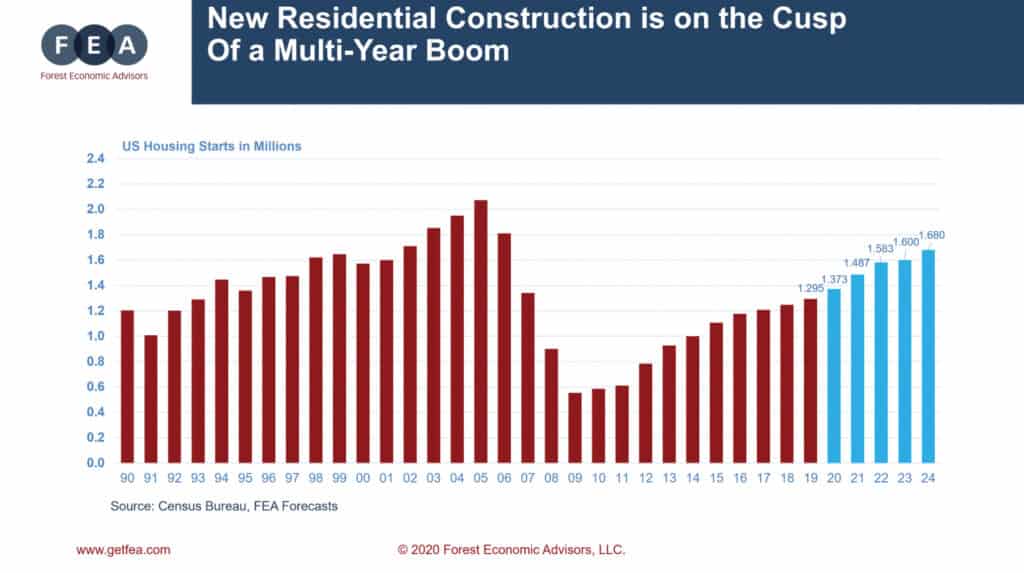

Additionally, “we are going to need to build 1.4 to 1.5 even 1.6 million housing starts to keep up with single family sales,” he said. “When we look at that, we are looking at a really robust new housing starts profile. For 2020 we have 1.37 million units. We are looking for four or five really, strong years of new residential construction.”

He added that R&R shall remain strong because the average age of U.S. homes is 42 years old. Jannke said, “So, if you are buying a median home in the U.S. there’s a good chance you are going to want to add on to it and improve it.”

He further added that many businesses are planning to keep around 20 percent of their workforce working remotely at any given point simply because it “makes business sense to do so.”

He also expects to see restaurants constructing more outdoor seating and these projects are opportunities for wood suppliers.

“A major market for wood products is industrial markets and the manufacturing sector,” he stated. “We were off sharply during the recession but the industrial sector has been growing over the past couple months. That’s certainly a positive sign and if we think about some of the on-shoring of our manufacturing, which has occurred over the past four years, we see that’s going to continue regardless of who wins the presidency.

“But we are also going to ship some wood overseas. This will increase slightly but not to the levels that we saw last decade.”

What are total lumber supply increase expectations for 2021?

Jannke explained: “We are looking for about a two billion board foot increase in the South, which is very aggressive – one and a half to two billion. We do know of green mills that are going to start. We know of older mills that have been shut down that are going to restart. There are expansions that are occurring and there will be some announcements of green mill capacity which those won’t likely get finished until 2022, but you will see some announcements of green mill capacity in the South. That explains the growth over the next couple of years in Southern production. We do actually have a pretty decent bounce back in the West – in part that is because of the decline in 2020. We might be a little aggressive in the last, especially given the fires but we are going to have salvage operations, which should help to increase supply there. We have BC bouncing back. It’s a little bit higher than our 2019 production levels, which a lot of people think is aggressive but we saw a lot of cutbacks in 2019 due to weak pricing and the much stronger pricing that we are seeing today should pull some mills back in to increase their production.”

Lastly, he said, “from a capacity perspective we are only looking for about a 0.5 percent to 1.0 percent of growth per year in capacity, whereas in consumption we do see going up, as I said five to six percent on average for the next two years so that should push operating rates into the lower 90 percent level.” Learn more at www.getfea.com.