By Michael Snow,

Executive Director

American Hardwood

Export Council

Sterling, VA

703-435-2900

www.ahec.org

Although softwood lumber often gets the headlines, the hardwood lumber trade between the United States and Canada is a vital industry, providing a consistent supply of valuable wood products. Canada was the largest export market for American hardwoods until it was overtaken in 2009 by China, but has remained a top trade partner through recessions, trade wars, and market downturns. Over the last 25 years, the United States has sent an average of over $305 million of hardwood lumber to Canada every year. This represents over 95 percent of Canada’s temperate hardwood lumber imports.

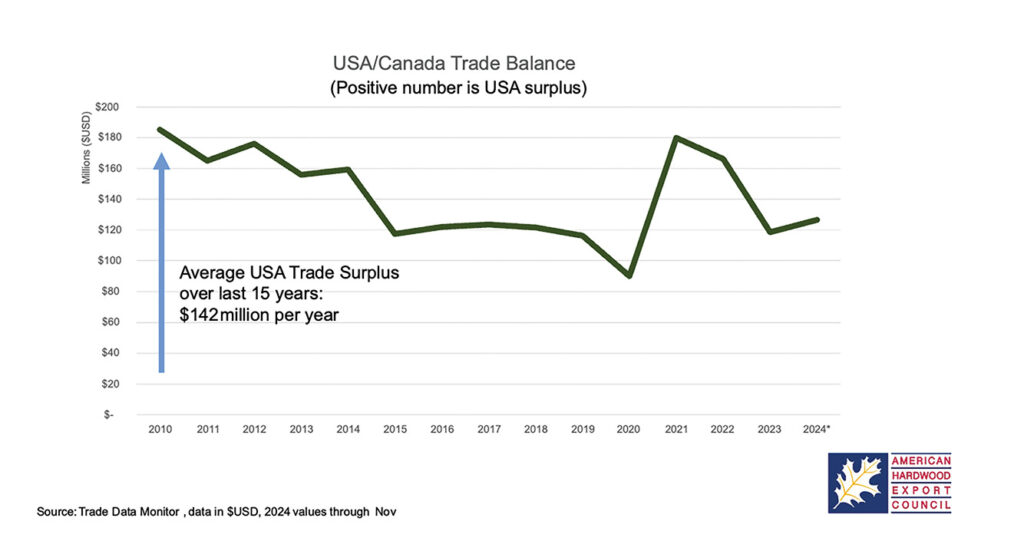

The top markets for Canada’s hardwood lumber exports are the United States, China, the UK, and Japan, with the United States purchasing over 50 percent of Canada’s total exports of hardwood lumber. Over the last 25 years, Canada has exported an average of $163 million of hardwood lumber to the United States. Both Canadian and U.S. hardwood lumber markets have moved in tandem in good markets and bad, so the trade surplus has averaged roughly $142 million per year in favor of the United States.

The United States has had an average trade surplus of $142 million per year in Hardwood Lumber

United States lumber exports to Canada through 2024 are up 10 percent from 2023 but are growing from a historically low level last year. The United States exported only $232 million to Canada in 2023. Going all the way back to 1992, there have only been two years that performed worse: the COVID outbreak year in 2020, and the start of the Global Financial Crisis in 2009.

Threats of U.S. and Canadian tariffs on lumber, including hardwood lumber, will undoubtedly affect trade if they are implemented. Luckily, it seems cooler heads have prevailed for the moment as the proposed tariffs have been delayed (at the time of this writing).

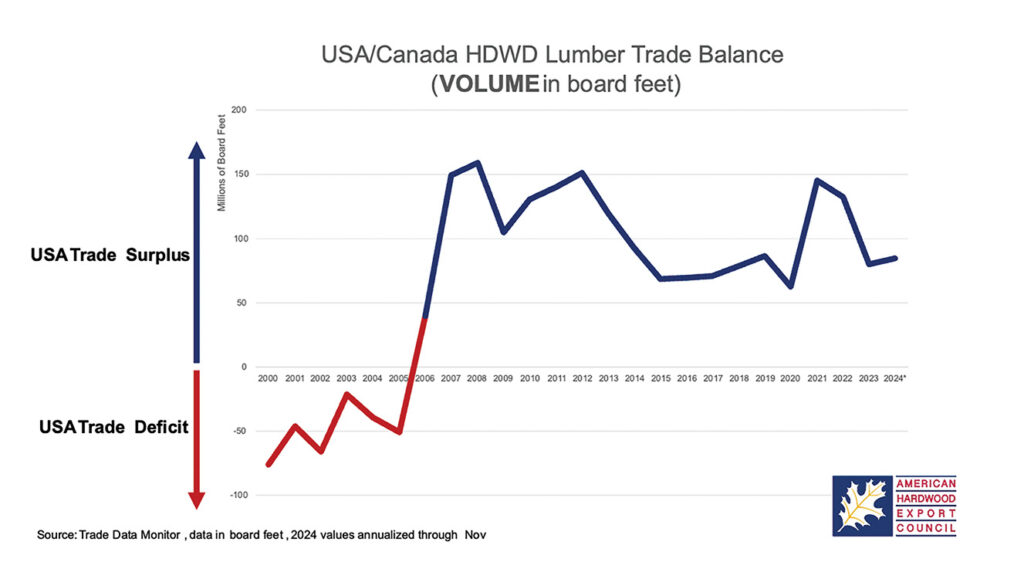

Although tariffs are paid based on the value of imports, it can also be helpful to look at trade volumes over the years. Due to price differences in the species of trade between the United States and Canada, the volume trade levels are much closer to parity than the value trade balance. As recently as 2005, the United States had a trade deficit with Canada of -51 million board feet by volume, even though the U.S. had a trade surplus of $91 million by value that same year.

By volume, the United States has had a trade deficit with Canada as recently as 2005

Over the last 15 years, the United States has had an average trade surplus in hardwood lumber with Canada of 101 million board feet per year.