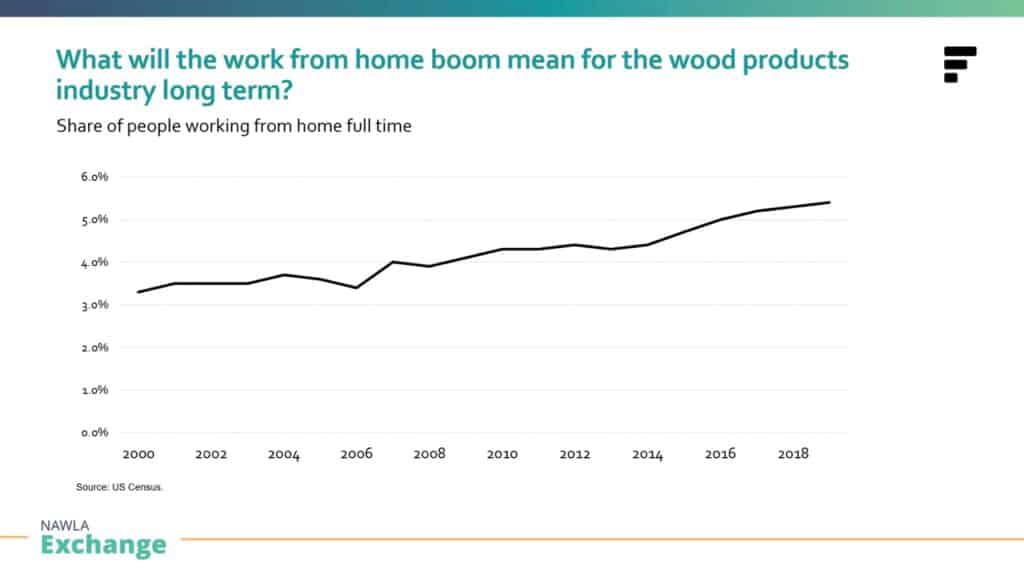

Fastmarkets RISI Senior Economist Dustin Jalbert recently reminded attendees during a virtual meeting that post-COVID – after the vaccinations are distributed plus society and the economy have adjusted to life with COVID – the possibility of more people permanently working from home may accelerate a trend being defined in the housing market. That trend, he noted, includes “more people having the flexibility to choose where to live and where they can work, such as the suburbs. You will see more home buying and bigger homes as a result, which I think is obviously very, very bullish for the wood products industry overall.”

Jalbert made his comments during the North American Wholesale Lumber Association Exchange meeting. His presentation was titled Outlook for the North American Wood Products Market: An Assessment of the Short- and Long-Term Impacts of COVID-19.

“I think what is important to keep in mind is that single family homes use about three times as much wood as multi-family uses,” he explained. “So that’s the big question of where the market is going to be in the coming years. A one percent share shift in the total housing starts – from multi-family to single family – increases demand incrementally by about 125-150 million board feet annually of softwood lumber. In our industry we have to keep in mind if that work from home share increases five to 10 percent points, that could be substantial in terms of the housing space we need going forward. Even pre-COVID, we expected a migration trend out of cities. COVID may be accelerating that. Realistically, our single-family share of projected housing starts is going to rise probably to 72-73 percent, which compares to 68-69 percent of starts for single-family from about 2015 to 2019.

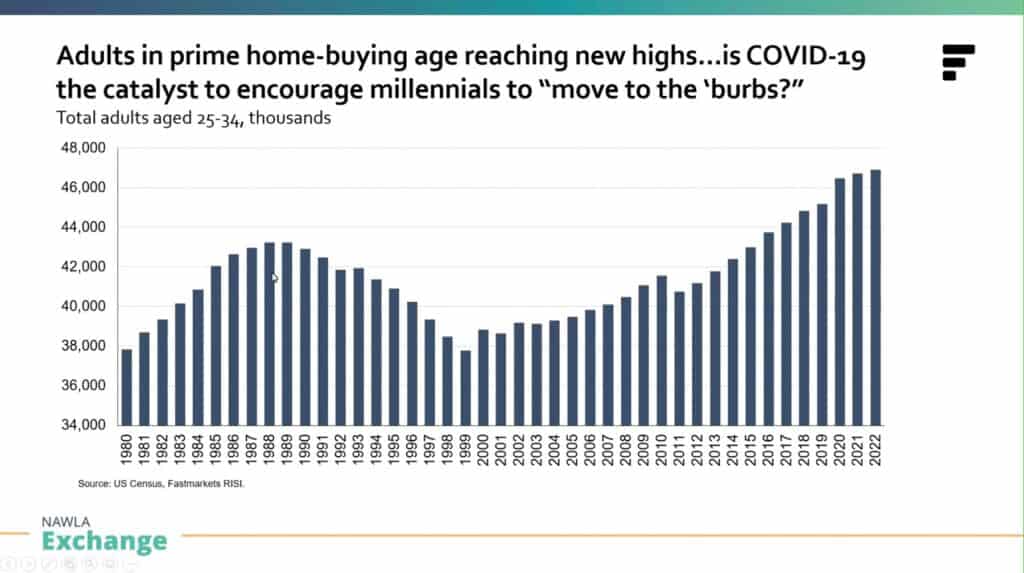

“Regardless of your view on COVID, demographics are strong for the housing market. We are in a tailwind in this industry.”

Game Changers in this Future Market?

Affluent Millennials will make a significant impact in home purchases the next few years, in large part due to the anticipated migration post-COVID out of cities. “There is some strong data available now that points in the direction that affluent Millennials who were considering buying a home anyway in a year or two from now, may be more prone to do so and COVID is the catalyst to accelerate this process,” said Jalbert.

COVID as a Market Disruptor

At the time of this writing, as COVID’s next surge in cases was exponentially increasing in the U.S., the pandemic’s disruption on the market was undeniable. Reviewing the injury to the economy and the lumber industry, Jalbert noted, “This COVID-related recession has actually occurred in about a quarter of the time as compared to the Great Recession of 2008 and 2009. But, it also has doubled in terms of the depth of the decline – doubled what we saw during the Great Recession. This has been immensely disruptive for the economy for many reasons.”

Jalbert cited the current unemployment numbers as concerning even though they have declined from the 25 million during the spring. Unemployment levels included both temporary and permanent job losses early in 2020. “I do think a better view of the employment market is actually to look at permanent job losses, which are reported by the U.S. Bureau of Labor of Statistics,” commented Jalbert. “The unemployment claims data and the unemployment rate masked the true underlying employment impact from this recession because of all the temporary jobs lost that have come back.”

How did the Wood Products Industry Respond?

“It’s pretty clear that the wood products industry from the get-go early on in this crisis anticipated the worst,” Jalbert said. “Also, when you look at another impact from COVID, we saw this historic level of curtailment in the industry, particularly in late March through May.

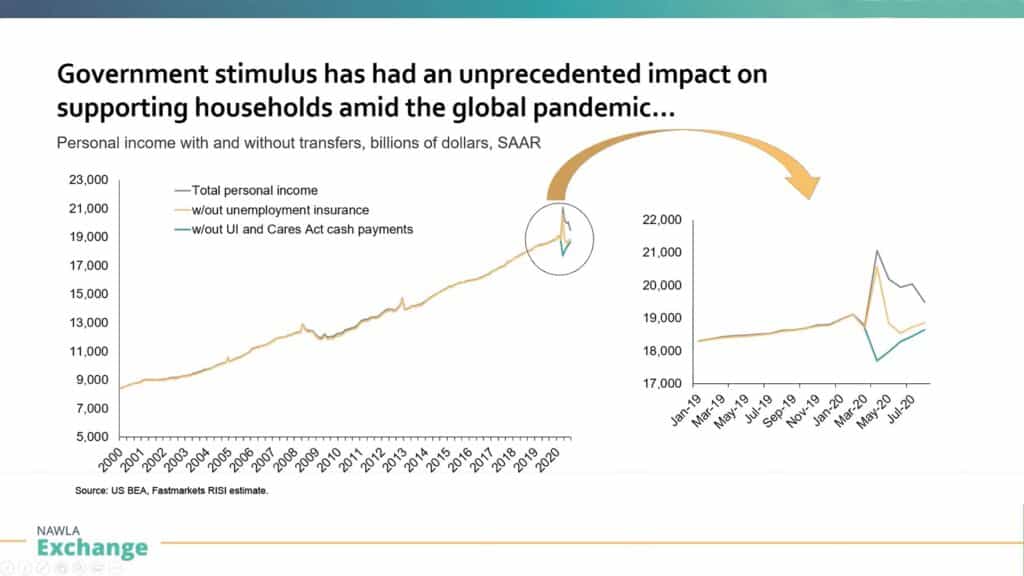

In the midst of it all, though, DIY projects began flourishing as people were working from home and many had disposable income due to income freed up as vacations were cancelled. Then a generous federal stimulus program was dispersed throughout the country. “People then invested very heavily into their homes,” explained Jalbert. “This was a huge support to the economy and in particular the wood products industry. It’s really important to acknowledge how impactful the federal stimulus has been on household personal income.”

Jalbert said the pace at which this tailwind from DIY projects took off wasn’t initially expected. That was followed, he noted, by the rebound in residential construction in tandem with rock bottom mortgage rates.

In regard to existing home sales, the story is a little different. “What is key here is the monthly supply of existing homes on the market is extremely tight,” Jalbert explained. “People are still very cautious to put their homes on the market in the middle of a pandemic, despite home price growth increasing 10 to 15 percent year-over-year. So that lack of inventory on the resale market has resulted in a massive tailwind for the new construction side of the market.”

The remodeling industry has enjoyed robust growth as well.

In summary, Jalbert noted that COVID-19 has been massively destructive to the North American economy. However, the American wood products industry has been resilient and while demand could be sluggish in 2021 with some of the lingering challenges in the economy, it is poised for accelerating growth. n